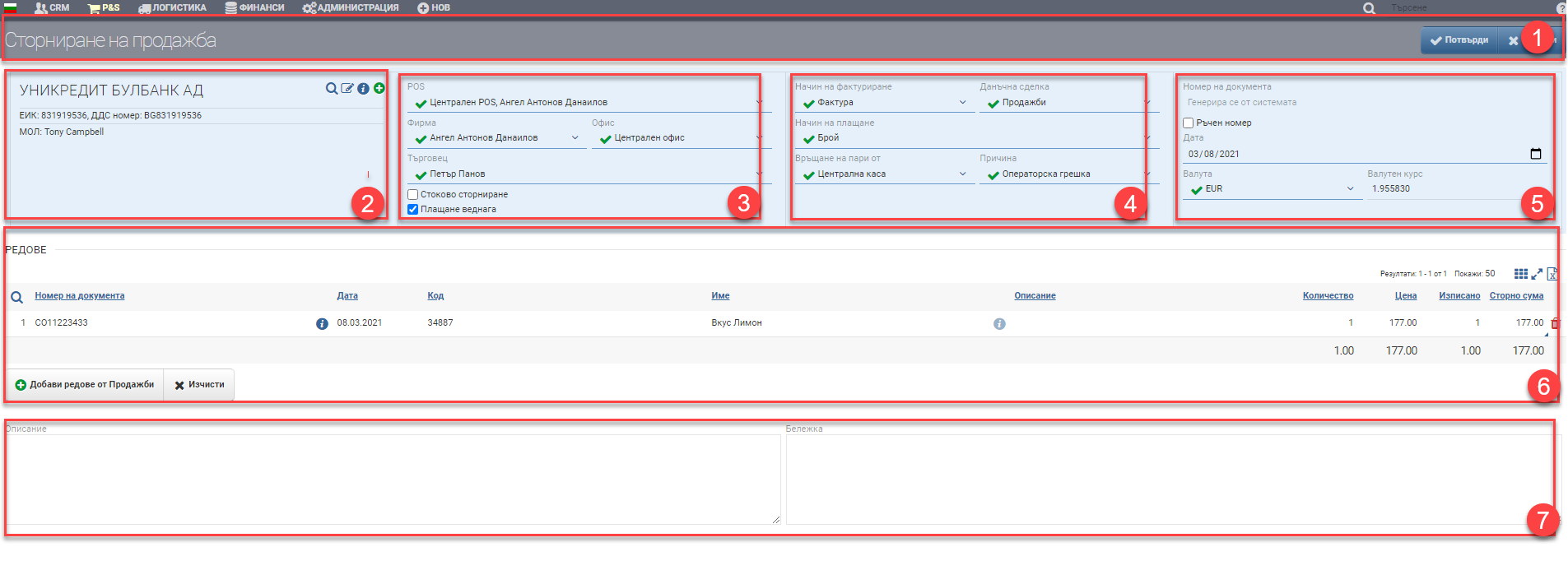

Interface for creating a sale reversal. The screen is divided into several parts: Header (1), Contractor (2), Company Data (3), Settings (4), Document Data (5), Lines (6), Description and Note (7).

Header (1)

In the Header (1) you see the name of the document you are creating and two buttons for Confirm and Cancel.

Contractor (2)

In the Counterparty section (2) you select the counterparty of the sale you will reverse. You can also view and edit the contractor’s file.

Company data (3)

In Company data (3) you must select the following data:

| Field/drawer | Description |

| POS | Choose from which POS you want to perform the reversal. The POS is linked to the store, cashier/account and warehouse and its settings determine where you will generate the associated reversal documents. |

| Company | You choose which company is doing the reversal. |

| Office | You choose from which office the reversal is made. The credit finance document will be generated by the office selected here( will take the appropriate numbering). |

| Merchant | Trader of the reversal |

| Stock clearance | Mark whether the reversal is a stock reversal, i.e. whether the items that were written off with the sale will be returned to the warehouse. This will also generate a reversal of the discharge once you confirm the document. If you don’t select that the reversal is a stock reversal, it will be generated as a price reversal and will not reverse the pick( will not return the stock to the warehouse). |

| Invoicing immediately | Mark whether the credit finance document should be issued with the reversal confirmation. If you don’t mark it, when you decide to issue the credit finance document you need to go into the Storing file and generate it. |

| Payment immediately | Mark whether you want the money back immediately on the reversal and specifically on his credit finance document. Payment immediately can only be marked if Invoice immediately is also marked, because payment is always by financial document. |

Price reversal

Most often, a price reversal sale is used to reduce the amount due for payment, for example when there is an operator error in the price or a reduction is made. Price reversal of a sale generates a Credit Finance Note and possible refund if the “Pay Now” checkbox is checked. It will not generate a reversal of the listing with which the goods left the warehouse.

Stock clearance

The goods on sale reversal is most commonly used for quantity adjustments as well as returns/returns. It will return the items to the warehouse by reversing the pick with which the items went out. In addition, it will also generate a Credit Finance Document and possible refund if the “Pay Now” checkbox is checked after you confirm the document.

Settings (4)

| Field | Description |

| Method of invoicing | You select which financial document was used to create the sale you are reversing. You must select the same document because it determines what credit financial document the reversal system will issue: – if your sale has an Invoice, the system will generate a Credit Note – if your sale is with a Receipt, the system will generate a Credit Receipt – if your sale is a Cash Receipt, the system will generate a Credit Receipt |

| Tax transaction | It is compulsory to choose the same tax transaction as the sale. |

| Payment method | You choose how to return the money to the customer. |

| Return of money from | From which cashier/account will you return money to the customer. A payment document will be generated from the selected cashier/account if you select Pay immediately in Company details (3). |

| Reason | You state what the reason for the document being reversed is: – Operator error – Return/Exchange – Reduction |

Document details (5)

Document data (5) includes the following parameters:

| Field/Checker | Description |

| Document number | The document number is automatically generated according to the set numbering rules. When the reversal is saved, the date and time are also saved. All documents that are automatically generated take these date and time. |

| Manual number | Checking “Manual Number” makes the Number field free for typing. The user decides what number the document will be. |

| Date of document | Date of issue of the document. Automatically loads current date, but can be changed by the user. |

| Currency | The currency of the document is selected from the list of currencies already entered. It is important that the reversal currency is the same as the sale currency. |

| Exchange rate | Exchange rate value for the day according to BNB. Can be changed manually by double clicking in the field. |

Lines (6)

In the section Rows (6) are automatically added rows from the so-called “quick reversal”, which is started from the file of a specific sale with the button “Reversal” and/or the user manually adds rows for reversal with the button Add rows from Sales.

The added rows are arranged in a table with the following columns:

| Column | Description |

| Document number | Sale number for reversal |

| Info button | Opens file of sale |

| Date | Date of sale for reversal |

| Name | Name of item to be reversed |

| Info button | Item file |

| Description | Item description |

| Quantity | Quantity for grouting |

| Price | Price from sale |

| Retrieved from | What quantity has been discharged from the warehouse |

| Storm amount | What amount/part of the sale amount will be reversed. The field is free to type and is activated by double clicking. Initially always load the full amount of the line |

| Commercial measure | Appears on a Stock Reversal and indicates the unit in which the sale was made. |

| Storm commercial quantity | Appears in the Stocks Reconciliation and manages the quantity for the stocks reconciliation. The field is free to type and is activated by double clicking. Initially, the entire order quantity from the sale is always loaded. In case of a stock reversal only the quantity is edited, not the price. |

Description and Note (7)

In the field Reason (7) the reason for the transaction is filled in free text. The reason is displayed on the printed form of the sale.

You may fill in Note (7 ) with whatever information you feel is necessary in free text. The note is not displayed on the printed form, but is rather for internal use.

Important Notes:

The cancellation of a sale whose items have not been removed from stock does not reduce the quantity to be removed. You have to run a write off on the sale and reverse the write off as well, if there are no quantities (the stock will remain negative) cancel the sale and only run a credit note to the invoice.

To save your changes, you need to click the Confirm button. If you want to exit without saving your changes, you need to click the Close button.