For a long time we have been working on a major change in the system related to the possibility of adding a different tax rate to each line of sales and its accompanying transactions and documents.

Prim.IO has added new features to the Sales and Finance Modules related to the reduction of the 9% rate for specific goods and services in the Value Added Tax (VAT) Act from July 2020. In addition to the new features, we had to change some already working elements in the Logistics Module related to the categories in the nomenclature.

We remind you that from the beginning of July 2020, on the basis of Article 66, paragraph 2, items 2-5 of the VAT Act, a reduced rate of 9 per cent will be levied, in addition to accommodation services and:

restaurant and catering services consisting of the delivery of prepared or unprepared food,

the delivery of books on physical media or carried out electronically, or both,

foods suitable for babies or young children, as well as baby nappies and similar baby hygiene items;

With the innovations in the system, we will meet the needs of our customers who are directly affected by the changes in the VAT Act, but also give a boost to their work with international and multi-channel sales. This is especially important for companies using Prim.IO for activities inside and outside the EU, because they often have to deal with different taxes than in Bulgaria.

The changes are related to the settings of taxes by categories of goods and services in the Logistics Module, the addition of new rates in the Finance Module and new sales logic in the Sales Module. These functionalities are also directly interconnected like everything else in the ERP system.

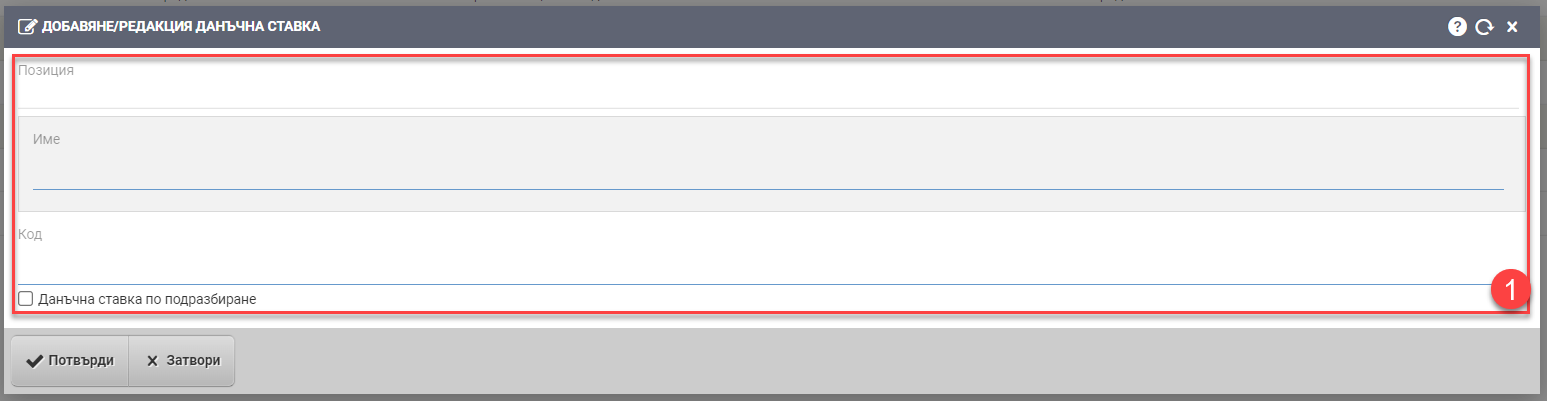

New Tax Rates functionality in the Finance Module, where you can define an unlimited number of tax rates. In the template system, they will be three – Standard( for 20% VAT), Reduced( for 9% VAT) and Exempt( for 0% VAT).

Change the settings in Categories and Features in the Logistics module. It is designed to set the tax rate at the level of the category of goods or services.

New Tax Rate Settings functionality, where you define the relationships between tax rates and tax transactions, so you can set a different tax rate for a category of goods or services, depending on the tax transaction. For example, in a “Sale outside the EU” tax transaction, your preferential tax rate for a category of books might be 20%, but in a “Sale within the country” tax transaction, your preferential tax rate would be 9%.