The ability to set different taxes and fees is part of our strategy to make a product that is usable in different countries. On the one hand, this is useful for companies that are not Bulgarian and need specific local taxes. On the other hand, such parameterization is extremely useful for many Bulgarian businesses that operate in multiple markets, especially in cases where they sell to end customers and have to register VAT numbers with different rates in different countries. If this is not your case, you can skip this section. We have tried to set up the system for the main tax transactions that are used in the country.

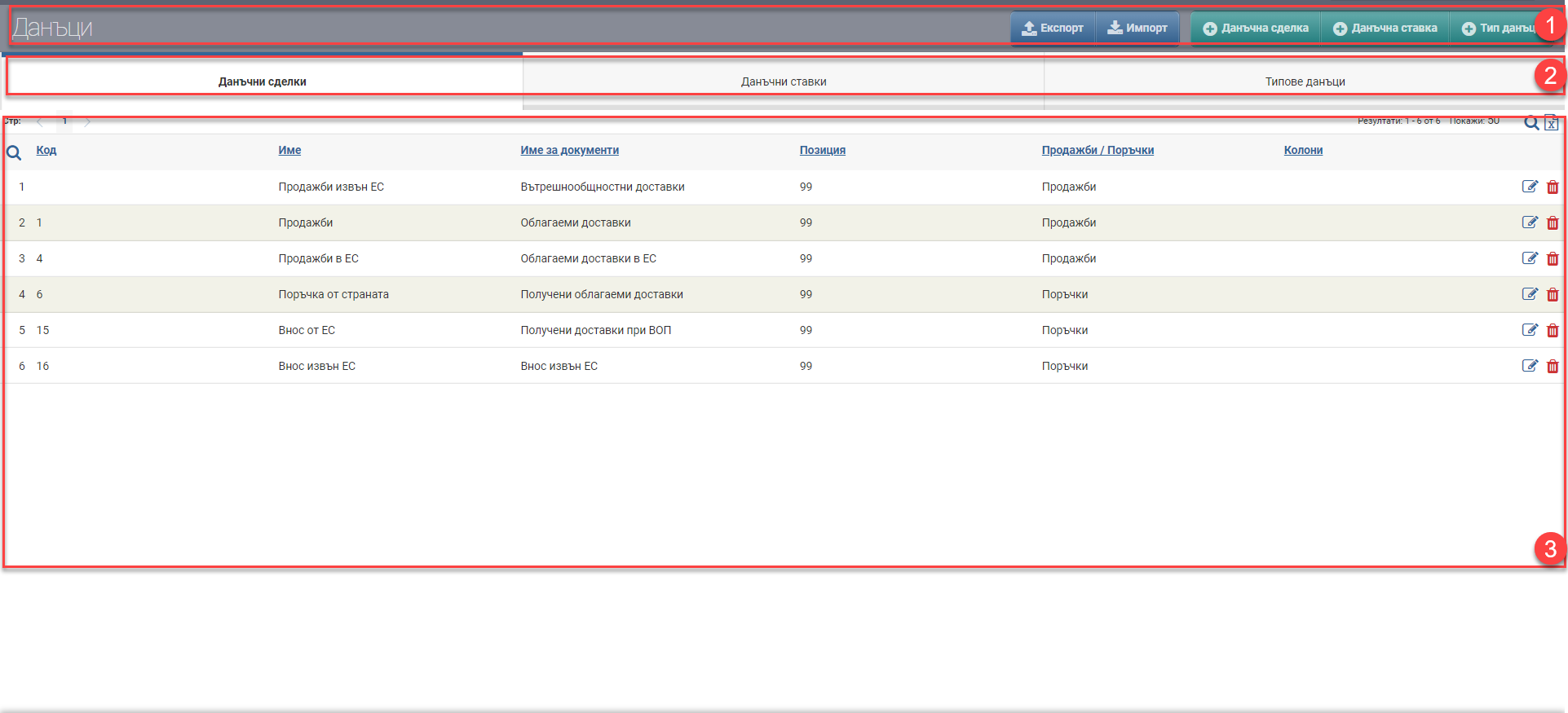

Tax transactions

In this tab, we set the actual applicable transactions in which we use the set taxes – for example, 0% VAT Imports, 9% VAT Taxable Supplies, Intra-Community Supplies, etc.

| Column | Description |

| Code | Transaction code |

| Name | Name of the transaction |

| Accounting name | Accounting name of the transaction |

| Sales/orders | |

| Self-assessment protocol | |

| Default | |

| Accounting | |

| Column (parish) | |

| Tax column (income) | |

| Tax column (expense) | |

| Tax column (expense) | |

| VIES | |

| VIES column base | |

| VIES column taxes | |

| Taxes included | |

| Excluded days |

Types of taxes

In this tab you can set different types of taxes – for example VAT, excise, state tax, etc.

| Column | Description |

| Code | Tax code |

| Name | Name of the tax |

| Status | Status of the tax |

Taxes

In this tab, the individual instances of each tax type are set – for example VAT 9%, VAT 20%, VAT 23%, Excise 5%, etc.

| Column | Description |

| Code | Tax code |

| Type | VAT/Askise/VAT1 |

| Name | Tax code |

| Current value | Current value of the tax |

You can perform the following actions on the lists:

- Rights settings – set the rights of counterparties (only for tax transactions);

- Edit – edit tax;

- Delete – delete tax;

- Activate/Archive – activate/archive (for tax types only).

For Bulgaria, we have specified additional information in the tax transaction setup that is subsequently used to generate purchase and sales ledgers. This is important for systems where the accounting module is also used. For the rest it is irrelevant.

If you want to add new tax transactions, especially if you also use the accounting module, it is a good idea to consult us for the correct settings.

Tax transaction rights are designed for one purpose – to limit who has access to which transactions. This makes the daily work of employees easier, as they do not necessarily see the full list of possible transactions, but only those they use.