Interface for creating and invoices on cash receipts. The functionality is used for invoicing sales for which financial documents (cash voucher) have been issued and payment has been made, in the following example cases:

- The customer shops throughout the month and at the end of the month wants you to invoice them based on their purchases.

- The customer has made a purchase but subsequently decides that he wants an invoice for it.

- The customer has shopped around and wants a third party invoice for all or part of their purchases.

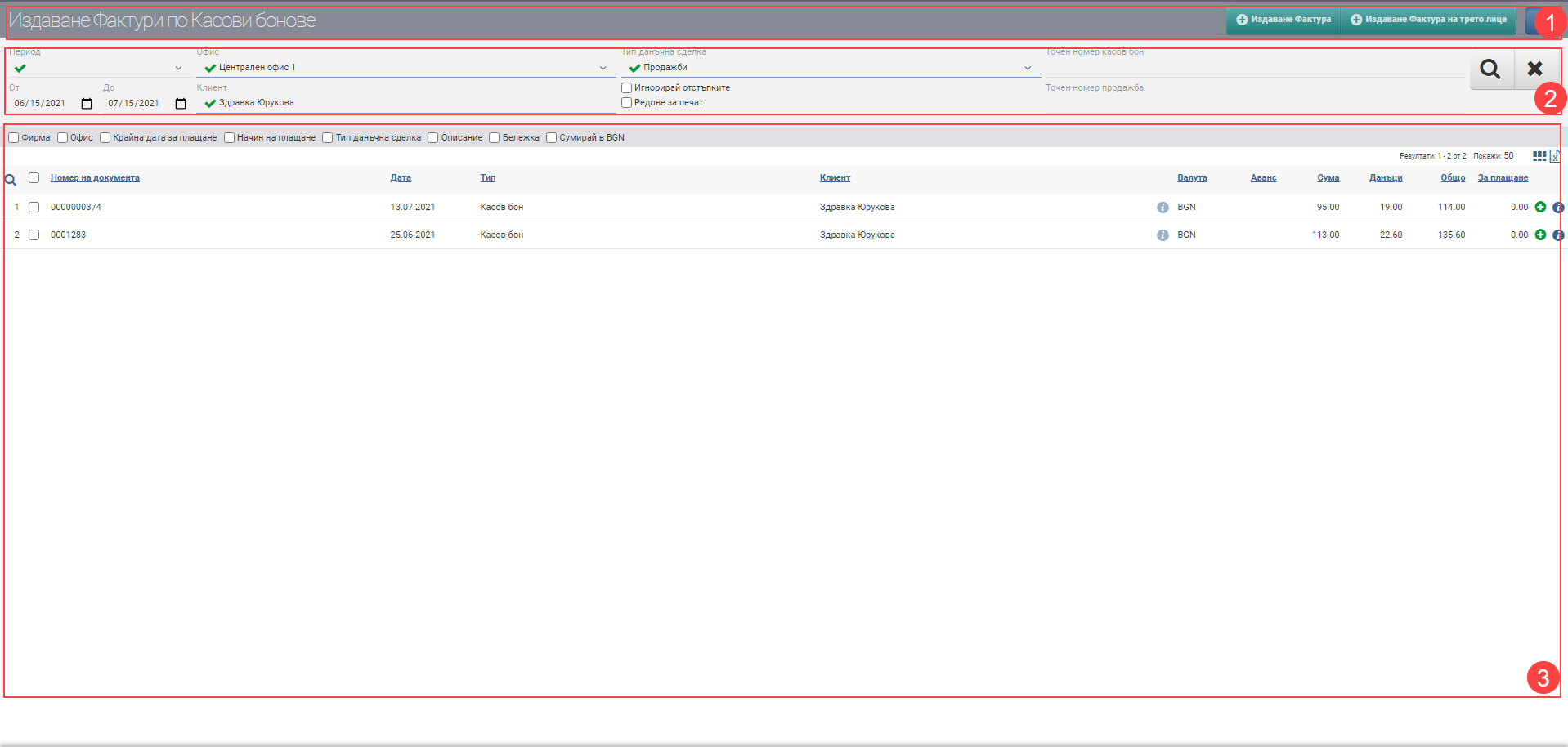

The interface consists of Header (1), Filter (2) and Result (3):

Header (1)

In the Header (1) you see the interface name, a button for Issue Invoice and Issue Third Party Invoice. The blue button is used to hide and display the Filter (2).

Filter (2)

To process your receipts faster, find them easier and faster, the system provides you with different ways to filter the information. The search is started with the Magnifying Glass, and the Hicks clears all filters. In the table below you will see all the filters and their explanations:

| Filter | Description | Further description of the options |

| Period | Choose from a drop-down menu for which period to display your financial documents. Works by document date. | The possible options are: – Today – Yesterday – The last 7 days – Last 30 days – The last 365 days – Current month – Previous month – Current quarter – Previous quarter – Current year – Previous year – Until today |

| From date – To date | You select specific dates as the period for which you want financial documents to appear. Works by document date. | |

| Office | Filter by the office from which the receipts were issued. | Select the office from which the document was issued. If a user has not been given the right to see a specific office, they will not see that office in the menu. You cannot invoice receipts issued by two or more different offices! |

| Client | Filter by the specific customer to whom the receipts are issued. | You cannot invoice receipts issued to more than one customer! |

| Type of tax transaction | Filter by the type of tax transaction set in the financial document. | Select Sales, Sales without VAT, Sales in EU, Sales outside EU, etc. depending on the tax transactions entered in the system. |

| Exact receipt number | Free search field for a specific receipt number. | |

| Exact sale number | Free search field for a specific sale number. |

In addition to the fields in the filter, there are two checkboxes “Print Lines” and “Ignore Discounts”.

If you put a check in “Print Lines”, then you will get print lines in the generated invoice that come up on the printed form with just the item description, measure, quantity, price and amount.

If you put a check in “Ignore discounts”, then the generated invoice will only “take” the final price of the items in the receipts.

Important:

In order for the financial documents entered by an office to be displayed to you, you must have rights to view the office!

The interface displays only financial receipts of type “Cash receipt” of the selected customer, from a specific office and with a specific tax transaction!

Result (3)

You will see the documents found according to the criteria set in the Filter (2) in the Result (3). Use the checks in front of each receipt to choose which documents you want to include in the invoice.

Result by Documents (3.1)

In the table you will see a list of financial documents containing the following columns:

| Column | Description |

| Checkbox | This is where you specify which receipts you would like to be included on the invoice. |

| Document number | Displays the financial document number. |

| Date | Indicates the date of the financial document. |

| Type | Indicates the type of the financial document. |

| Client | Shows the counterparty in the financial document. |

| Opens a contractor file. | |

| Currency | Currency of the financial document. |

| Advance | Not applicable. |

| Sum | Sum of all lines in the invoice excluding taxes. |

| Taxes | Amount of taxes in the document. |

| Total | Amount of document with taxes. |

| For payment | How much of the total amount of the document has not yet been paid. |

| Issue an invoice for the specific receipt only. | |

| Opens a file on a financial document. |

In addition to the columns containing basic information about the cash vouchers, you can include and exclude the following additional columns of detailed data by means of checks:

| Column | Description |

| Company | Indicates in which company the financial document is entered. |

| Office | Indicates in which office the financial document was entered. |

| Status | Paid/Unpaid |

| Final date for payment | Displays the specified end date for payment in the document. |

| Payment method | Indicates the payment method of the financial document. |

| Type of tax transaction | Displays the selected tax transaction type on the financial document. |

| Description | Displays the description entered to the financial document. |

| Note | Displays the entered note to the financial document. |

| Sum in BGN | Adds a row in the footers table with the totals of the amounts in columns: – Sum – Taxes |

A brief step-by-step description of the procedure for issuing invoices on cash vouchers:

1. Log in to Invoices by Cash Receipt, where you filter the information with the Filter (2) and find the cash receipts you want to invoice.

2. Mark all the receipts you want to include in the invoice by placing a check in the checkbox in front of each document in the Result (3).

3. Depending on whether the invoice you want to issue will be to the same customer as in the cash vouchers or will be different, use the Issue Invoice or Issue Third Party Invoice button located in the Header (1) of the interface respectively.

4. Both buttons will issue an invoice, in the interface to create a new financial document, as:

- when you issue an invoice, after confirming the transaction, the system directly shows you the file of the issued invoice

- when Issuing an invoice to a third party after confirmation, the system requires you to select to which customer the invoice will be issued in the Select Third Party interface. Once you have selected/created the Customer, you confirm and the invoice will be generated and you will see their file on screen.

5. After the invoice is issued, the payments that were to the cash vouchers are automatically linked to the invoice. The same applies to sales.