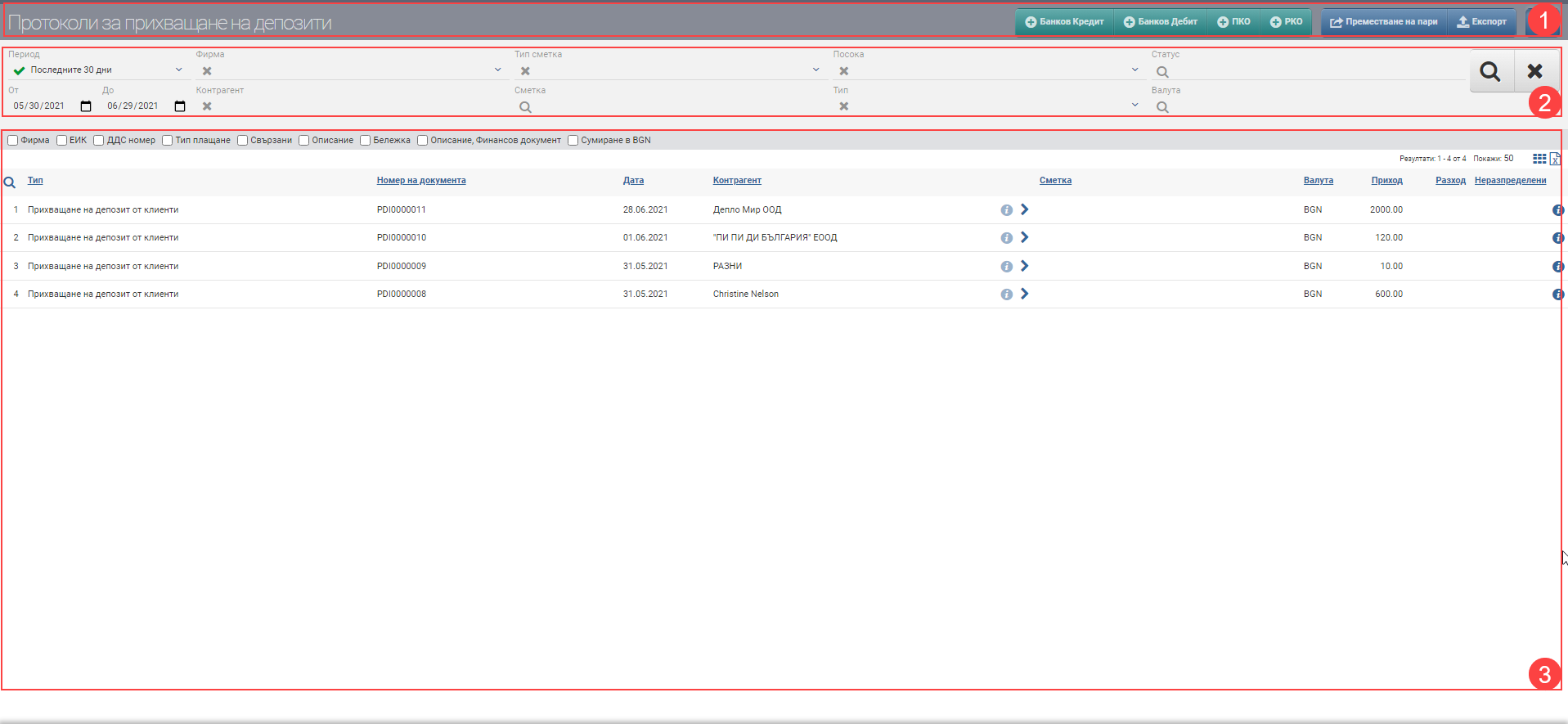

Interface for managing deposit interception protocols. You can filter results based on different criteria and create payments/moves if you have the appropriate permissions. The screen is divided into three main parts: Header (1), Filter (2) and Score (3):

Deposit offset reports are automatically generated by the system when you cover the payment of a financial document with an available deposit taken from the customer.

The documents generated from the deposit intercept are lined up in this interface as well as in the intercepted financial documents file so that there is better traceability.

Header (1)

In the Header (1) you see a button to hide/show the Filter (2), a button to Export payments, and buttons to create payment documents according to the permissions you have:

Filter (2)

In order to process your payment documents faster, to monitor their status and development, the system provides you with different ways to filter the information that often comes from several cash registers/accounts. The search is started with the Magnifying Glass, and the Hicks clears all filters. In the table below you will see all the filters and their explanations:

| Filter | Description | Further description of the options |

| Period | Choose from a drop-down menu for what period to display your customer deposit offset reports. Works by document date. | The possible options are: – Today – Yesterday – The last 7 days – Last 30 days – The last 365 days – Current month – Previous month – Current quarter – Previous quarter – Current year – Previous year – Until today |

| From date – To date | You select specific dates as the period for which to display the customer deposit offset reports. Works by document date. | |

| Company | Filter by company. | |

| Contractor | Filter by the specific counterparty to/with whom the deposit offset reports are entered. | |

| Account type | Filter by Account Type on deposit offset reports from customers. | Choose from the following options: – Bank account – Cass |

| Account | Filter by specific account. | You are only shown accounts that you have rights to at least see. |

| Direction | Not applicable. | Not applicable. |

| Type | Not applicable. | Not applicable because they are always on financial documents. |

| Status | Not applicable. | |

| Currency | Filter by document currency. |

Result (3)

You will see the deposit interception protocols found by customers according to the criteria set in Filter (2) in Result (3). In the table you will see a list of documents containing the following columns:

| Column | Description |

| Type | Displays the type of payment document – customer deposit intercept protocol. |

| Document number | Displays the document number. |

| Date | Displays the date of the document. |

| Contractor | Displays the counterparty in the document. |

| Opens a contractor file. | |

| Filters by counterparty. | |

| Account | Not applicable. |

| Not applicable. | |

| Currency | Currency of the document. |

| Coming | Shows amount of payment, always a revenue payment document. |

| Cost | Not applicable. |

| Unallocated | Not applicable. |

| Opens a file of deposit intercept minutes from customers. |

In addition to the columns containing basic payment information, you can also include and exclude additional columns of detailed data by check. You can additionally include:

| Column | Description |

| Company | Indicates in/which own company the document was issued/registered. |

| UIC | UIC of the counterparty with whom the protocol is associated. |

| VAT number | VAT number of the counterparty with whom the protocol is associated. |

| Payment type | Displays the type with which the payment was entered. It is always by financial documents |

| Related | Displays the numbers of all transactions related to the protocol (financial documents, sales, orders). The numbers are also links, so clicking on them opens the file of the related operation. |

| Description | Displays the description entered with the payment. |

| Note | Displays the note entered with the payment. |

| Description, Financial document | Displays the description entered to the financial document tied to the payment. |

| Sum in BGN | Adds a row in the totals foot of the table to the amount in the Income column. |

Colours by status

In addition to the information that the system gives you about the protocols through the columns in the Table, another way to easily recognize their status is included- this is the visual coloring. It varies according to the stage at which the documents are:

| Colour of the payment document | Description |

| Black | Deposit offset minutes from customers are regular. |

| Grey | The deposit offset protocol from customers has been cancelled. |