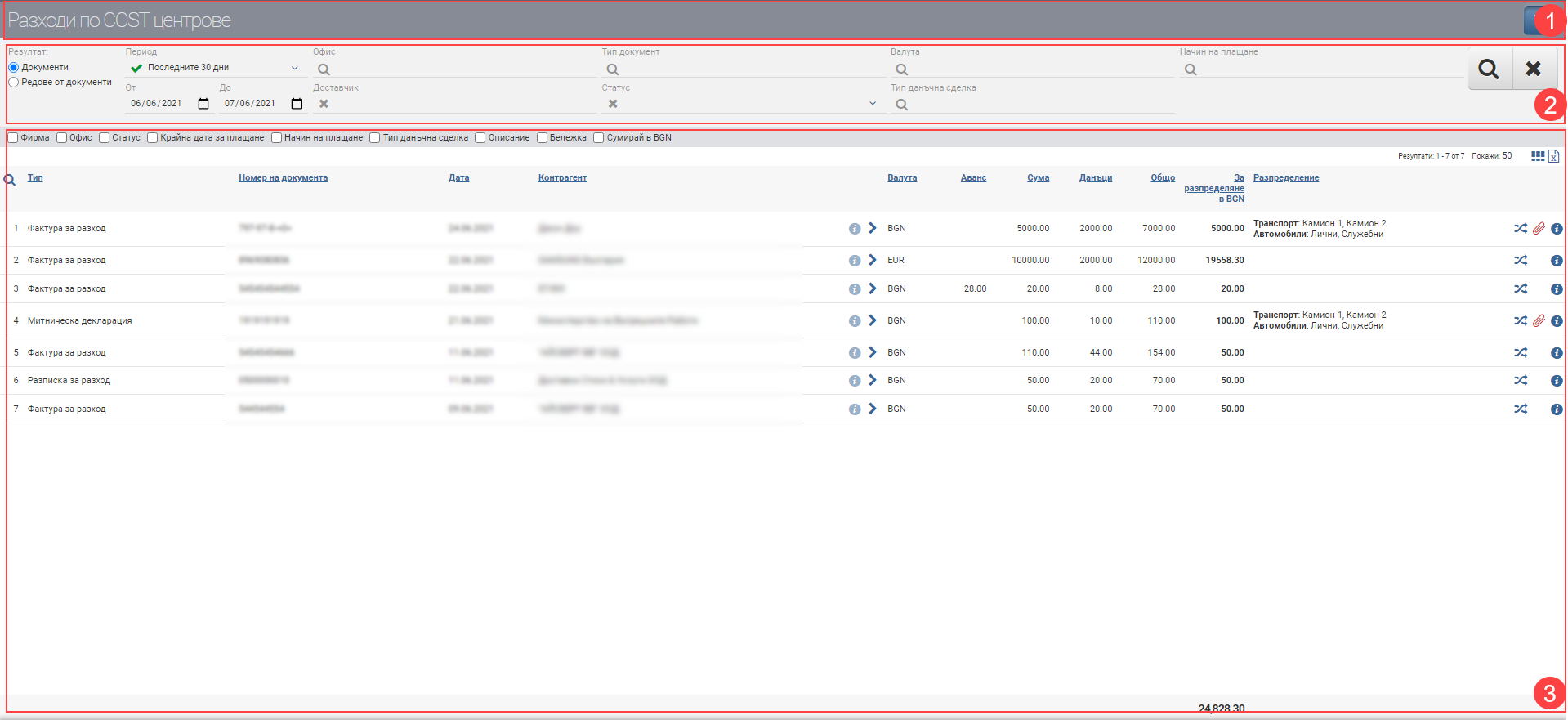

Interface for the operational activity of allocating costs to COST Centres, consisting of a list of allocated and unallocated cost financial documents entered with category/categories marked as “Cost for COST Centres”. If you would like to track the costs already allocated by month and COST Centre, please use the Costs by COST Centre reference.

You can filter the results based on different criteria. The screen is divided into three main parts: Header (1), Filter (2) and Score (3):

Heather (1)

In the Header (1) you see the interface name and a blue button that hides and shows the Filter (2).

Filter (2)

In order to process your financial documents faster and keep track of whether they have already been allocated, the system provides you with different ways to filter the information. The search is started with the Magnifying Glass, and the Hicks clears all filters. In the table below you will see all the filters and their explanations:

| Filter | Description | Further description of the options |

| Result | – Documents view (3.1) – Document Lines view (3.2) | |

| Period | Choose from a drop-down menu for which period to display your financial documents. Works by document date. | The possible options are: – Today – Yesterday – The last 7 days – Last 30 days – The last 365 days – Current month – Previous month – Current quarter – Previous quarter – Current year – Previous year – Until today |

| From date – To date | You select specific dates as the period for which you want financial documents to appear. Works by document date. | |

| Office | Filter by the office where the financial documents are entered. | Select the office where the document is entered. If a user has not been given the right to see a specific office, they will not see that office in the menu. |

| Status | ||

| Supplier | Filter by the specific supplier that issued the financial documents. | |

| Document type | Filter by Financial Document Type. | The possible options are: – Invoice expense, includes Debit Expense Note, Credit Expense Note and Invoice Expense Note – Expense Receipt, includes Debit Expense Receipt, Credit Expense Receipt, and Expense Receipt. – Tax document, includes Customs declaration. |

| Payment method | Filter by the payment method that created the financial document. | Choose by bank, cash, POS, etc. depending on the payment methods entered in the system. |

| Type of tax transaction | Filter by the type of tax transaction set in the financial document. | Select Sales, Sales without VAT, Sales in EU, Sales outside EU, etc. depending on the tax transactions entered in the system. |

| Currency | Filter by currency of the financial document. | |

| Status | Filter by Financial Document Status, which can be Allocated/Unallocated. | |

| Distributed by | The financial document has been distributed. | |

| Unallocated | Financial document not yet distributed. |

Important:

In order for the financial documents entered by an office to be displayed to you, you must have rights to view the office!

The interface only displays financial expenditure documents created with an expenditure category that is marked for allocation “COST Centre Expenditure”!

Result (3)

You will see the found documents/series of documents according to the specified criteria from the Filter (2) in the Result (3). The table changes the information according to the Result type, so they will be described separately.

In addition to the columns containing basic information about the financial documents, you can also include and exclude additional columns of detailed data by checking off additional columns. All main and additional columns are described according to Result type.

Result by Documents (3.1)

In the table you will see a list of financial documents containing the following columns:

| Column | Description |

| Type | Indicates the type of financial document. |

| Document number | Displays the financial document number. |

| Date | Indicates the date of the financial document. |

| Supplier | Shows the counterparty in the financial document. |

| Opens a contractor file. | |

| Filters by counterparty. | |

| Currency | Currency of the financial document. |

| Advance | Shows amount of advance financial document. If you have an invoice in advance, the amount will be displayed as a positive number in this field. If you have a final invoice covered by an advance, the amount of the advance used will show as a negative number in this field. |

| Sum | Sum of all lines in the invoice excluding taxes. |

| Taxes | Amount of taxes in the document. |

| Total | Amount of document with taxes. |

| For distribution in BGN | How much of the invoice total is entered with a category for allocation to COST Centres. |

| Distribution | Shows which COST Centres the document is allocated to. |

| Opens an interface for allocating costs to COST Centres. | |

| Disconnects the document distribution. | |

| Opens a file on a financial document. |

You can additionally include:

| Column | Description |

| Company | Indicates in which company the financial document is entered. |

| Office | Indicates in which office the financial document was entered. |

| Status | Paid/Unpaid |

| Final date for payment | Displays the specified end date for payment in the document. |

| Payment method | Indicates the payment method of the financial document. |

| Type of tax transaction | Displays the selected tax transaction type on the financial document. |

| Description | Displays the description entered to the financial document. |

| Note | Displays the entered note to the financial document. |

| Sum in BGN | Adds a row in the footers table with the totals of the amounts in columns: – Sum – Taxes – Total |

Result by Lines of documents (3.2)

A list of document rows will appear in your table. If a financial document has 3 rows with 3 rows with different categories for sales allocation, then here they will be on three different rows. The row-by-row table contains the following columns:

| Column | Description |

| Type | Indicates the type of financial document. |

| Document number | Displays the financial document number. |

| Date | Indicates the date of the financial document. |

| Supplier | Shows the counterparty in the financial document. |

| Opens a contractor file. | |

| Filters by counterparty. | |

| Description | Displays a description of the order of the financial document. |

| Name | Displays the name of the item/service. |

| Currency | Currency of the financial document. |

| Measure | Shows measure. |

| Quantity | Displays the quantity of the item/service. |

| Price | Shows the price of the item/service/item excluding taxes. |

| Tax | Displays taxes on the item/service/item. |

| Sum | Displays the price including taxes of the item/service/item. |

| Distribution | Shows which COST Centres the document is allocated to. |

| Opens an interface for allocating costs to COST Centres. | |

| Disconnect the order distribution. | |

| Opens a file on a financial document. |

You can additionally include:

| Column | Description |

| Company | Indicates in which company the financial document is entered. |

| Office | Indicates in which office the financial document was entered. |

| Category | Indicates which category the line is entered with to the financial document. |

| Documents | Displays the documents linked to the row. |

| Sum in BGN | Adds a row in the footers table with the totals of the amounts in columns: – Sum – Taxes – Total |

A brief step-by-step description of the COST Centre cost allocation procedure:

- You go to COST Centre Expenditure, where you filter the information and find the financial document/line of the financial document you want to allocate.

- Click on the desired financial document/line of a financial document.

- You use the filters and find the sales/sales lines on which you want to allocate an additional cost in the Cost Allocation pop-up.

- You mark the desired objects by COST centres, you define the percentage distribution in the pop-up for Cost Allocation.

- You click the Confirm button, which allocates the additional cost.

- You can find all already accumulated costs per COST Centre in the column Allocation in the reference Costs per COST Centre.

- You can unlink an already allocated expense by clicking on the row of the desired document and then repeat steps 1 to 5 again if necessary.