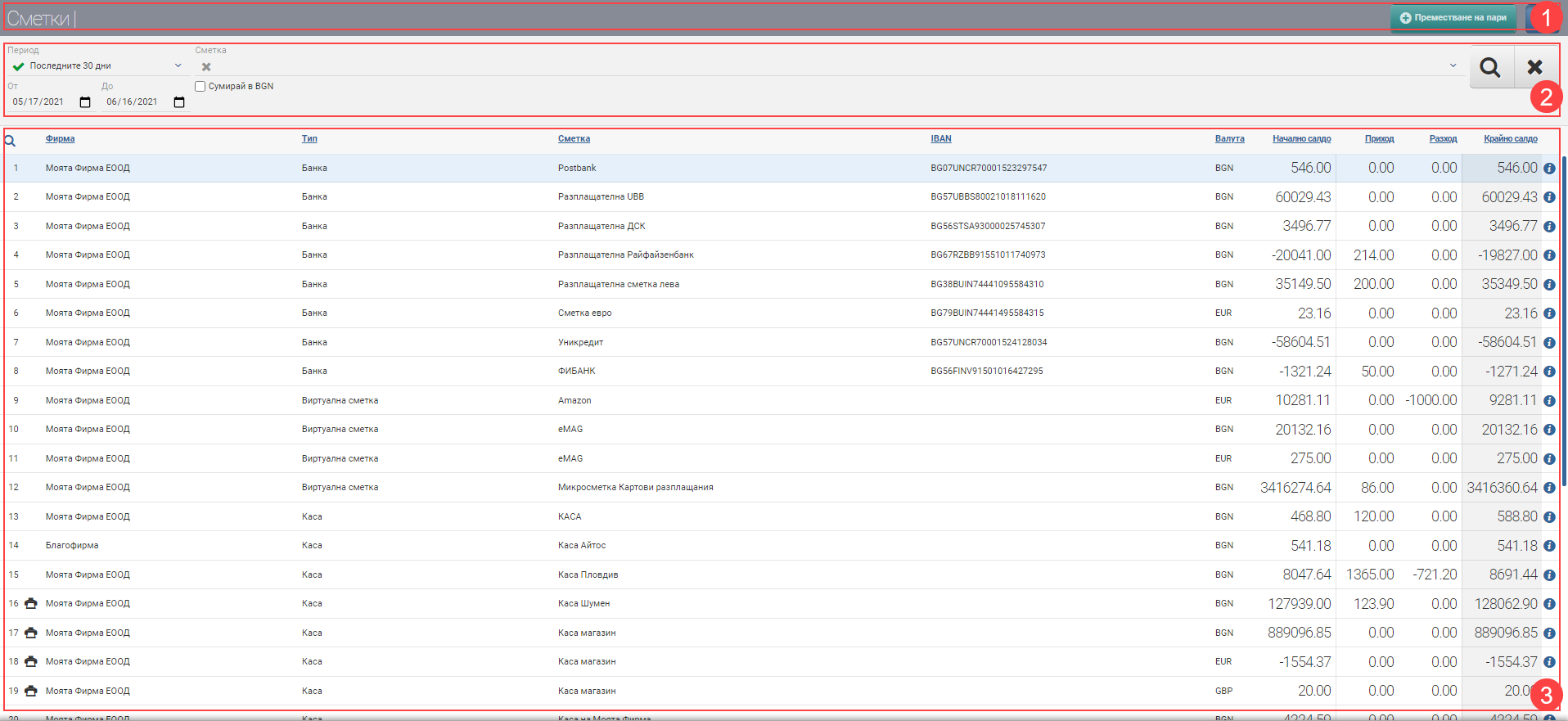

Accounts (no specific account selected)

Interface for managing all accounts – bank, treasury and virtual, for which the user has rights. Here you get information about account balances, movements, you can filter the result by different criteria, as well as create payments and move money. The screen is divided into three main parts: Header (1), Filter (2) and Score (3).

Heather (1)

In the Header (1) there is a button to Move Money between accounts (if you have permissions to move money) and a blue button to hide and show the Filter (2).

Filter (2)

To make it easier for you to keep track of your account balances, the system provides you with different ways to filter your payment information. The search is started with the Magnifying Glass, and the Hicks clears all filters. You can search by period for 10/30/60 days, etc., by period of specific dates, and by account. If you select an account, the result will change ( you can read about this further down the page).

A checkmark placed in the “Sum in BGN” checkbox will change the Result (3) , with the Starting Balance for Period, Income, Expense and Ending Balance for Period columns changed to Starting Balance for Period BGN, Income BGN, Expense BGN and Ending Balance for Period BGN. That is, the amounts will be recalculated from their original currencies into their lev equivalent.

If you have not specified that you want the total in BGN, the table shows you the amounts in the original currency of the account.

Result (3)

Without a specific account selected, the Result (3) shows you all accounts you have rights to at least see. The information is summarised in a table with the following columns:

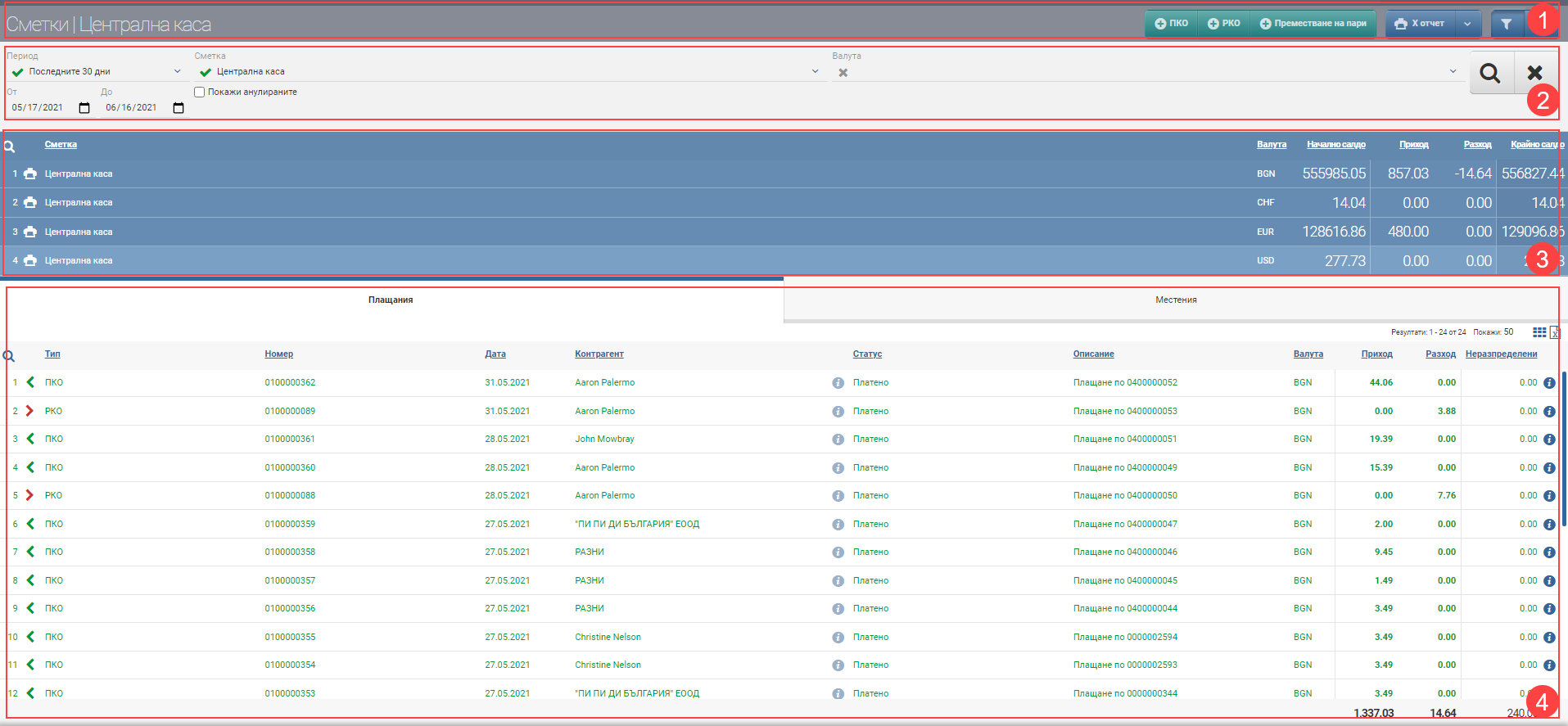

Accounts (with a specific account selected)

If you select an account in the Filter or click on the Info button of any specific one in the list, the interface changes and the result is different.

On this interface you can get information about a specific account. The screen is divided into four main parts: Header (1), Filter (2), Information (3) and Operations (4).

Header (1)

In the Header (1) you can find buttons that allow you to create the following operations( if you have permissions):

If there is a cash register connected to the account , the following action buttons are added, depending on the model:

- X report – runs a daily report on the cash register without resetting the cash register, can be run at any time.

- Z report – runs a daily report on the cash register that resets the cash register. Runs at the end of the day or when cashiers change.

- Monthly report – plays a monthly report of the cash register for a specific period selected by the user

- Annual Report – plays an annual report of the cash register for a specific period selected by the user

- Date to date – runs a report on the cash register for a specific period selected by the user

- Reconcile cash – the system reconciles the account balance and the cash register balance. If there is more in the account issue a document of service import. If there is less in the account than in the cash register, the system issues a service export.

- Department Partial Payments – sends a command to the cash register to program a department for a partial payment. It is done once at the beginning or when the setting is lost.

- Unblock – used when the cash register has an open receipt and for some reason the payment is not completed. The system sends a specific command to unlock the device by cancelling or ending the note.

- Recalibrate Clock – used when the cash register is running late/lagging for some reason and recalibrates its clock according to the system.

Filter (2)

The options in Filter (2) allow you to filter by period, date and currency. You can also view cancelled payments by ticking the“Show cancelled” checkbox

Summary information (3)

The Summary Information section (3) displays the most general data about the selected account. If the account works with several currencies, the information is split into several rows (for each currency). The field consists of:

| Field | Description |

| Company | Shows the company that uses the account. |

| Type | Shows the type of account – bank, cash or virtual. |

| Account | Displays the name of the account. |

| IBAN | Displays the IBAN of the account (if it is a bank account). |

| Currency | Displays the currency of the account. |

| Opening balance for the period | Account balance at beginning of period. |

| Coming | Total accrued income from all revenue documents for the period. |

| Cost | Total accrued expense from all expense documents for the period. |

| Ending balance for the period | Account balance at the end of the period. |

Operations (4)

In the Operations section (4) you can find information about all Payments and Transfers made for the selected time period, divided into two tabs of the same name.

Tab Payments

The information about the entered payment documents/payments is displayed in a table with the following columns:

Tab Displacements

Information about Money Movements is displayed on a separate tab in the Interface. It loads a table with the following columns: