Interface for creating payment documents, applicable for:

- Cash receipt order – PCO

- Expenditure cash order – RCO

- Bank debit

- Bank credit

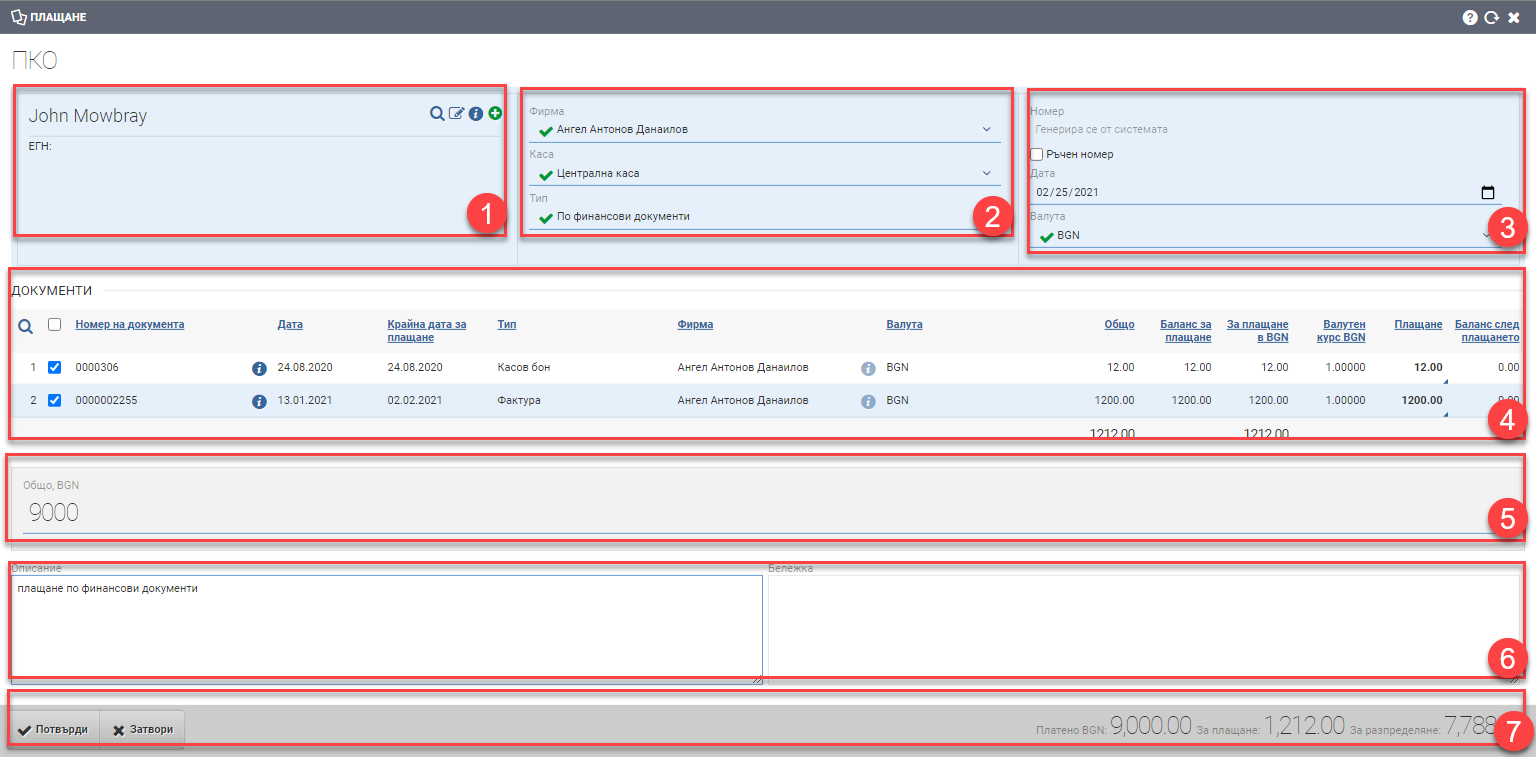

The screen is divided into several parts: Contractor (1), Company Details (2), Additional Information (3), Lines (4), Amount (5), Basis and Note (6) and Footer (7).

Contractor (1)

In the Counterparty section (1) you can select an existing counterparty (Search) or add a new one (Create) to or from which to post the payment.

Company data (2)

In the Company section (2) you need to select the Company and the account for the payment – it can be a bank account or cashier. Only accounts for which your user is an MOL are displayed. More information about the rights on accounts can be found here.

| Field | Description |

| Company | Company issuing or reflecting the document. Select from a drop-down menu. |

| Cashier or bank account | The cashier or bank account from or to which the payment is reflected. Selectable from a drop-down menu that shows only accounts for which your user is an MOL. More information about the rights on accounts can be found here. |

| Type | You select the payment type from a drop-down menu, with the following options: – By financial documents means that the payment you register will cover fully or partially one, two or many specific financial documents. You have to select them by checking the checkboxes in Row (4). If you do not select any financial document to cover the payment, it will remain unallocated. – Without a counterpart financial document is used to reflect payments for which you do not and/or will not have a financial document. They automatically become completed and do not wait for allocation (they are coloured green). – A return of overpayment is used to reflect a return of money from a supplier or a return of money by a customer, and you must link the payment to a financial document in Line (6). – Deposit from customer is used in the revenue payment documents (CCP and bank credit) to reflect deposits taken from customer. Payment is eventually refunded at a future time with a Return of Deposit from a customer. – Return of deposit from customer is used in the payment documents (RCO and bank debit) for return of deposit taken from customer. – Deposit to supplier is used in payment vouchers (PCD and bank debit) to reflect deposits given to a supplier. Payment is eventually returned at a future time with a Return of Deposit to provider. – Return of deposit to supplier is used in the revenue payment documents (CCR and bank credit) to return a deposit to a supplier. |

Note that for the different types of payment documents- receipts and disbursements, the locations of Counterparty (2) and Company Data (3) are interchanged.

Additional information (3)

You must select the Date and Currency of the payment document, and note the number in the Additional Information section (3):

| Field/Checker | Description |

| Document number | The document number is automatically generated according to the set numbering rules. |

| Manual number | Checking the box will remove the automatically generated payment document number and makes the number field free to write. The user decides what number the document will be. |

| Date of document | Date of issue of the document. Automatically loads current date, but can be changed by the user. |

| Currency | The currency of payment. Select from the list of currencies already entered. |

Lines (4)

In the Rows section (4) after selecting a contractor you will see a table with all documents that need to be paid (awaiting full or partial payment) for the selected contractor and company. The system will show you the following columns in this table:

| Column | Column |

| Document number | Financial document number |

| Info button | File of financial document |

| Date | The date on which the document was created |

| Final date for payment | Payment deadline |

| Type | Document type Credit, Debit, Invoice, Receipt, Cash account |

| Company | The company selected for the financial document |

| Info button | Shows you more information about the previous column, in this case the contractor file. |

| Currency | Currency of the document |

| Total | Total amount with taxes |

| Balance for payment | What is the amount to be paid |

| For payment in | The total amount calculated in the system’s default currency |

| Exchange rate | The exchange rate between the currencies of the sender and the receiver |

| Payment | Payment amount. Cannot exceed the amount in the “To be paid” field. |

| Balance after payment | What part of the amount remains to be paid after the payment has been recorded |

Selecting a financial document for payment is done by placing a check in the checkbox of its row. You are then also given the option to write in a Payment column, and you can specify a smaller, equal or larger amount.

If you specify a larger amount, your financial document will settle, and the remainder will be in unallocated payment status.

If you specify a smaller amount, your financial document will not be fully covered and you will be left with a balance to pay.

You will also see the Amount field (5) where you can also specify the payment amount.

Important! Be sure to enter all amounts with periods – 10.10, not commas – 10.10.

Sum (5)

The Amount section (5) gives you information about the total amount of the payment you are creating, as well as how much of it is allocated and unallocated:

| Field | Description |

| Total, currency | The total amount of the payment and its currency. |

| Currency | Currency of payment |

| Total | Total payment amount. The minimum value is 0.01. |

| Distributed | What part of the payment is allocated by financial documents. |

| Unallocated | What part of the payment remains as unallocated, i.e. not tied to financial documents. |

Important! Be sure to enter all amounts with periods – 10.10, not commas – 10.10.

Base and Note (6)

The Reason (6) field shall be filled in free text with the reason for the payment. It is displayed on the printed form of the payment document. In Note (6) you can fill in whatever information you think is necessary in free text. The note is not displayed on the printed form, but is rather for internal use.

Footer (7)

In the Footer (7), in addition to the Confirm or Decline buttons on the right, there is also information about the status of the amounts:

- Paid – total amount of payment entered

- For payment – total amount of payments allocated by financial documents

- For distribution – total amount of unallocated payment that will remain ‘free’ for distribution

Depending on how you add a payment, the type you select, and the amounts you add, the values in the Footer (7) are automatically calculated after each change. You can use it as a handy reference point because it’s a fixed location, no matter how many rows of financial documents you have.

To save your changes, you need to click the Confirm button. If you want to exit without saving your changes, you need to click the Close button.

How do I add a payment amount?

1. Select counterparty/ company/ cashier/ payment type/ currency.

2. Select financial documents for payment from the lines by placing a tick.

3. Determine the payment amount and write the amount in the “Payment” field of each selected financial document line:

- the amount of the payment may not exceed the payment obligation.

- the amount may be less than the liability and the balance remains as balance after payment;

- the amount cannot be negative;

3. Keep track of what happens in the Footer (7) and confirm the document.

Valid formats, according to the bank with which the bank statement is imported

Когато теглите файла от банката и имате повече от една сметка, винаги избирайте конкретна сметка!

Формат на файла според банката, с който се импортира банково извлечение в системата:

| Банка | Тип файл | Особености |

| Allianz | XLS | |

| Експресбанк | MT940 | |

| ДСК | MT940 | |

| ОББ | XML и ТXT | ТXT файлът трябва да е с разделител “|” . За да се обработи коректно файла, трябва да е натисната отметката “Подробно извлечение“. Ако отметката не е отбелязана, системата ще разчете редовете като банкови такси. |

| ПроКредит | XLS | |

| Райфайзенбанк | MT940 | |

| Уникредит Булбанк | XML | |

| FIBank | MT940 | |

| PostBank | XML |