Interface for creating a financial document applicable to:

- Invoice, Advance invoice

- Expense invoice, Advance expense invoice

- Pro forma invoice

- Proforma invoice for expenditure

- Cash voucher

- Receipt

- Receipt for expenditure

- Debit note for expenditure

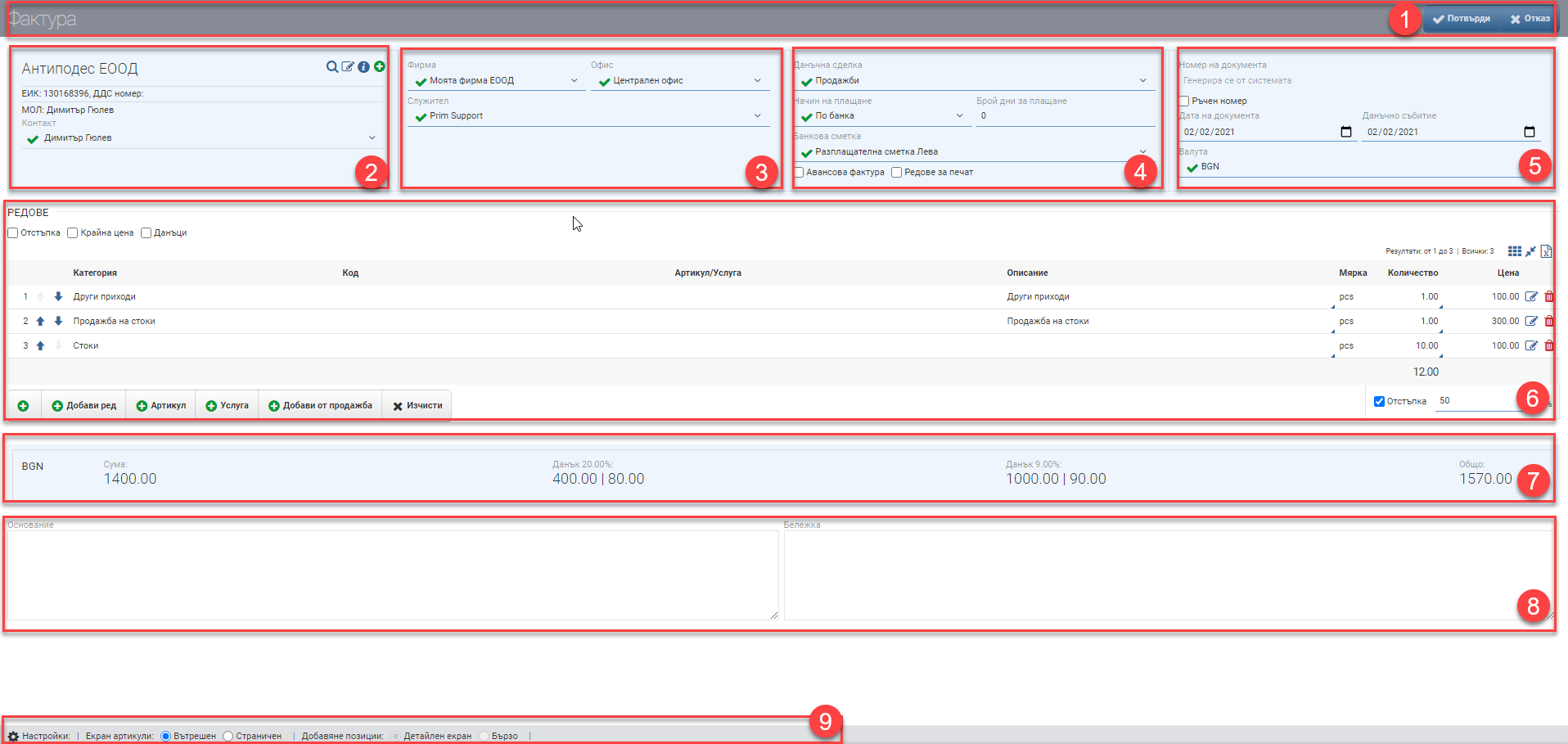

The screen is divided into several parts: Header (1), Contractor (2), Company Data (3), Financial Settings (4), Document Data (5), Rows (6), Totals (7), Justification and Note (8), Configuration of how to add rows (9).

Header (1)

In the Header (1), you see the name of the financial document you are creating, as well as two buttons to Confirm and Cancel the document.

Contractor (2)

In the Counterparty section (2) you can select an existing counterparty (Search) or add a new one (Create). You can view the information of the customer you are billing.

Company data (3)

Then you select fill in the Company details (3):

| Field | Description |

| Company | Company that issues the financial document. Select from a drop-down menu. |

| Office | Office from which the financial document is issued. Selectable from a drop-down menu that shows only the offices the user is authorized to work with. |

| Employee | Officer issuing the financial document |

Note that for the different types of financial documents- revenue and expense, the locations of Contractor (2) and Company Data (3) are interchanged.

Financial settings (4)

You then complete the Financial Settings (4) section of the document:

| Field/Checker | Description |

| Tax transaction | Choose from a drop-down menu of preset Tax Transactions. |

| Payment method | Choose from a drop-down menu of preset Payment Methods. If you select the “Cash” method, you will see a “Pay Now” box. The system allows the payment to be created together with the financial document, and you have to select which cash register to reflect it in. If you choose the “By Bank” method, you must select which bank account the payment will be reflected in. The selected bank account will be displayed in the printed form of the financial document. |

| Number of days for payment | You fill in the number of days to pay in free text if it is not predefined in the Limit Settings in the counterparty’s file. |

| Advance invoice | Indicate whether the financial document is an advance by inserting a check. |

| Lines for printing | You add another tab to the Rows (6), which you can edit as you wish. By including a Checker on Print Lines, only these lines will be displayed in the printed form of the financial document ( in PDF format). |

Document details (5)

Document data (5) includes the following parameters:

| Field/Checker | Description |

| Document number | The document number is automatically generated according to the set numbering rules. When the invoice is saved, the date and time are also saved, and all documents that are automatically generated take these date and time. |

| Manual number | Checking the box removes the automatically generated revenue document number and makes the Number field free to write. The user decides what number the document will be.The number is entered manually in the following cases: always on cost financial documents in each document when ticking the “manual number” box |

| Date of document | Date of issue of the document. Automatically loads current date, but can be changed by the user. |

| Tax event | Date of tax event. Automatically loads current date, but can be changed by the user. |

| Currency | The currency of the document is selected from the list of currencies already entered. |

Lines (6)

In the Lines section (6) you can manually enter items, services, revenue or expense categories or import a file. There are edit and delete buttons at the end of each line. The system will calculate the total of the rows in Totals (7).

The buttons below the rows open the add interfaces, which are described in the following pages:

- adding the last added line again. If there is no line added, adds the last line entered in that document type, regardless of which user did it. + button

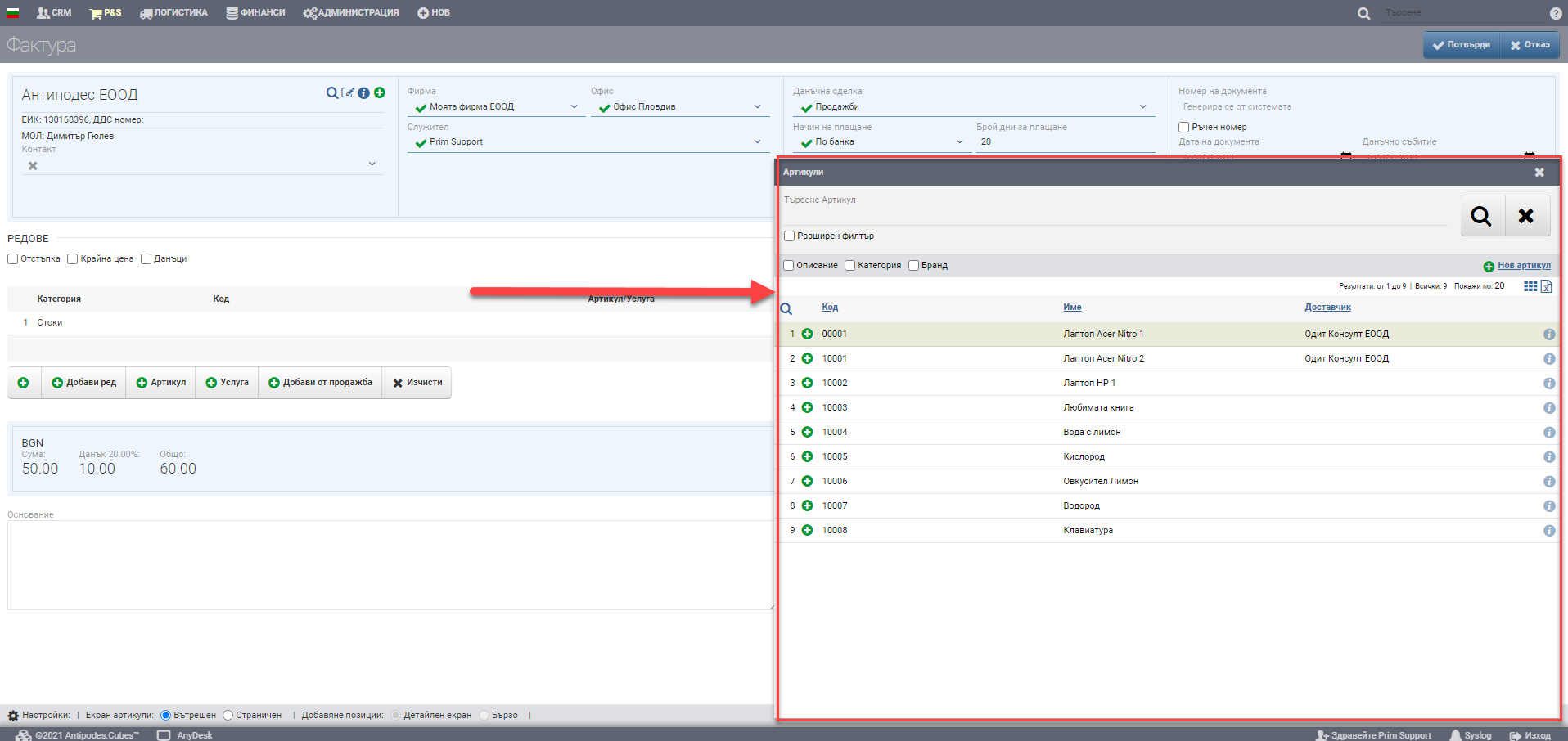

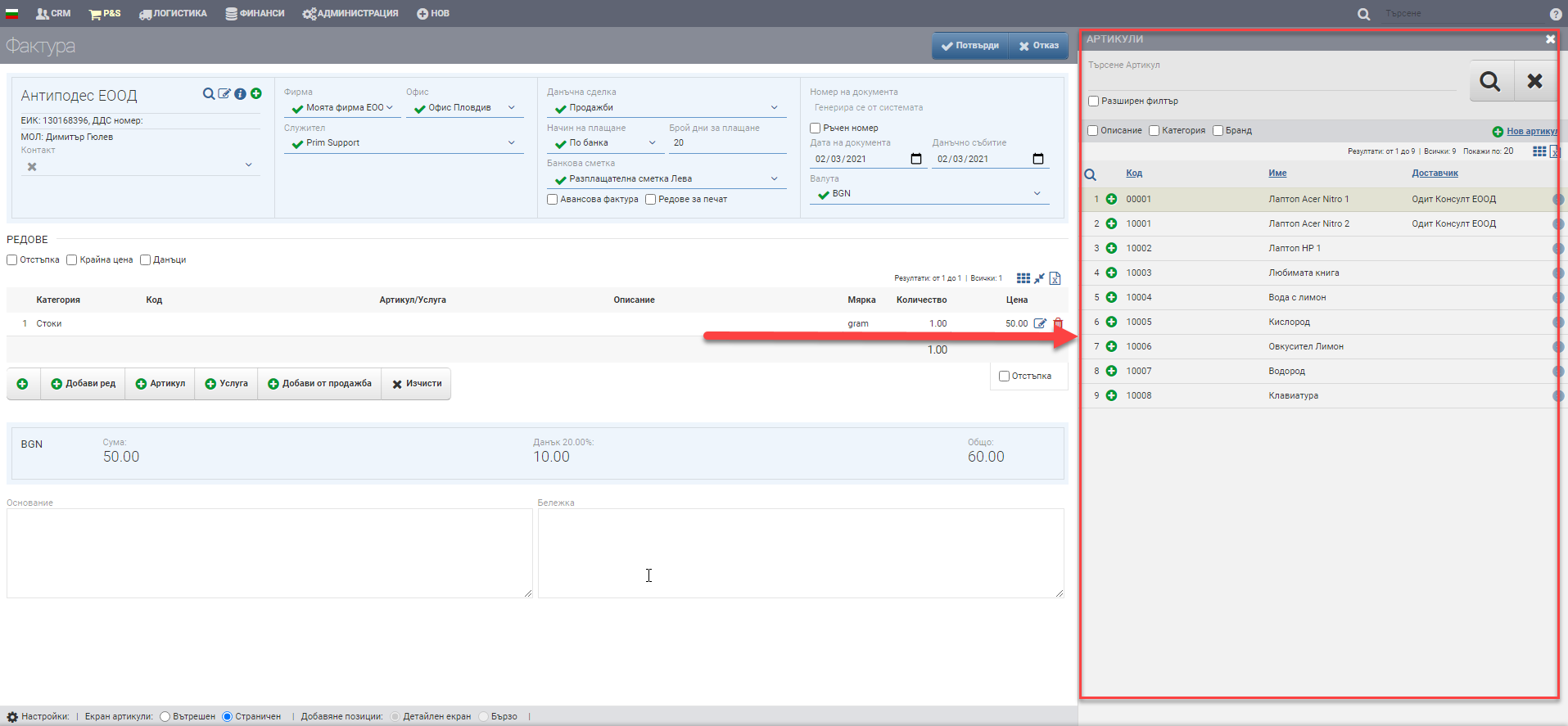

- add an item, service or line with a financial category ( without a specific item/service) – button + item/service/line

- add a line from a sale or order – button + add sale/order

- button to use available advances +use advance ( which appears after you have entered a line in the document and only if there is an available advance)

- adding a debit invoice to a debit note

Above the rows you can include/exclude additional columns to the rows with the following content:

| Column | Description |

| Discount | Allows you to enter a discount to the price of the item (if you are eligible) |

| Final price | Shows the final amount excluding taxes |

| Taxes | Shows the tax based on the prices of the items |

Totali (7)

The system automatically calculates the total of the lines in Totals (7) and shows you the following data:

| Field | Description |

| Currency | Currency of the financial document |

| Sum | Tax basis of the financial document |

| VAT | Value of VAT as well as % VAT |

| All | Final payment amount = tax base + VAT |

In case you have lines with different tax rates in the financial document, separate fields for each different VAT value as well as the % VAT will be displayed in Total (7).

Base and Note (8)

In the field Reason (8) the reason for the transaction is filled in free text. The justification is displayed on the printed form of the financial document.

In Note (8) you can fill in whatever information you think is necessary in free text. The note is not displayed on the printed form of the financial document, but is rather for internal use.

Configure how to add rows (9)

The ways to add items and services are managed by the Add Row Method Configuration (9). Inserting a tick only changes the position of the interface, without changing how it is operated. The views can be:

- Internal

- Sidebar

To save your changes, you need to click the Confirm button. If you want to exit without saving your changes, you need to click the Close button.