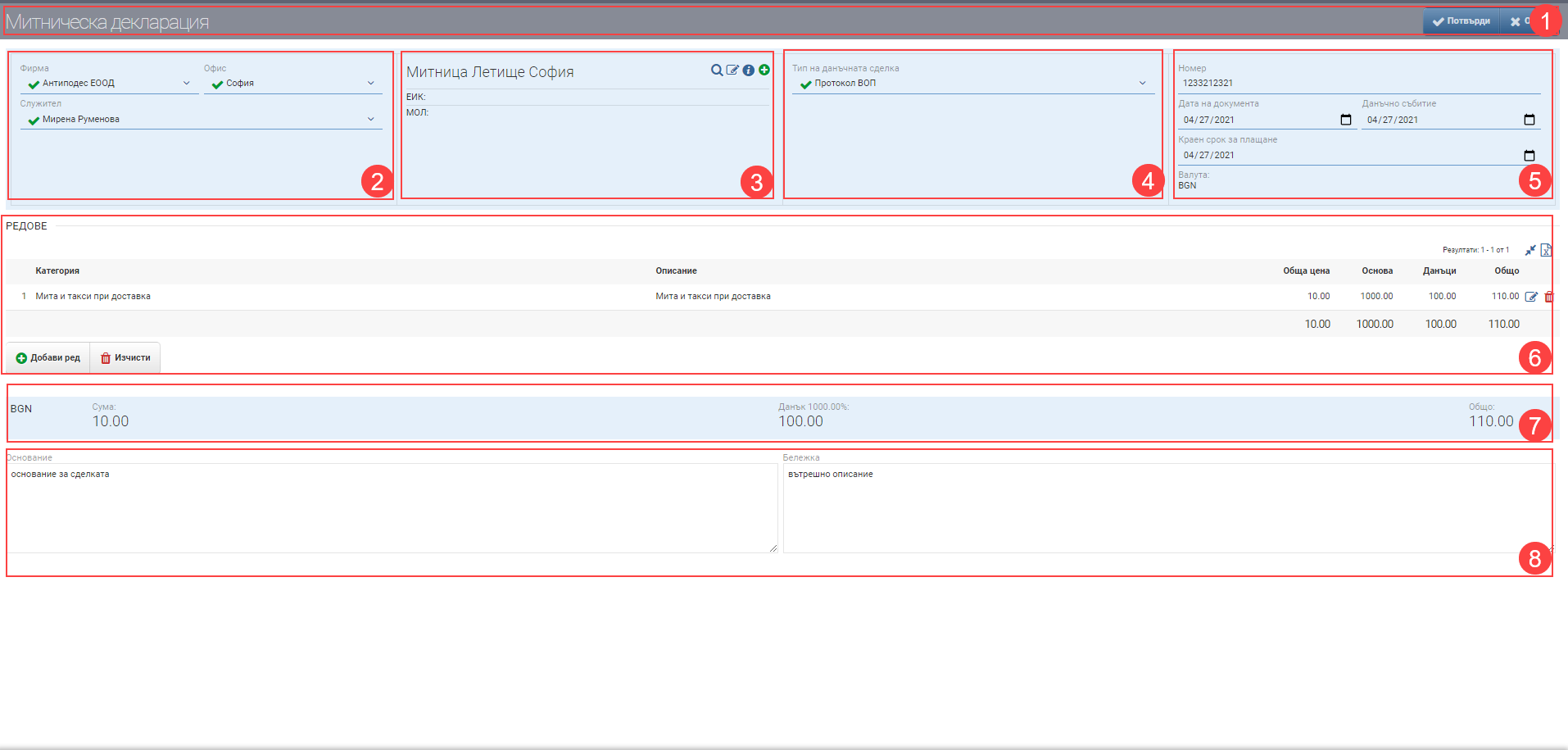

The interface consists of Header (1), Company Data (2), Counterparty (3), Financial Data (4), Document Data (5), Lines (6), Total (7) and Description and Note (8).

Header (1)

In the Header (1) you see the name of the document you are creating and two buttons to Confirm and Cancel the Customs Declaration.

Company data (2)

In Company details (2) you must select your own company and the office where you will register the Customs declaration, as well as the official responsible for the document.

Contractor (3)

In the Contractor section (3) you can select an existing contractor of type Government organization, add a new one or edit it. There is also an option to view the contractor’s file.

Financial data (4)

In the Financial data section (4), select Tax transaction type from the drop-down menu.

Document details (5)

In the Document Data section (5) you must fill in the following parameters:

| Field/Checker | Description |

| Document number | Enter a document number, the field is free to write. |

| Date of document | Date of issue of the document. Automatically loads current date, but can be changed by the user. |

| Tax event | Date of tax event. Automatically loads current date, but can be changed by the user. |

| Deadline for payment | Payment deadline. Automatically loads current date, but can be changed by the user. |

| Exchange rate | The currency of the document is selected from the list of currencies already entered. |

Lines (6)

In the Lines section (6), manually enter the lines of the Customs Declaration using the Add Line button. The system will calculate the entered data and calculate the total of the lines in Total (7).

The table consists of the following data:

| Column | Description |

| Category | Financial category selected in order. |

| Description | Description of the introduced line. |

| Total price | Entered value of Mito fee. |

| Background | Base value entered. |

| Taxes | Entered tax value. |

| Total | Automatically calculates the data entered in the Fee and Tax fields. Total with taxes = Fee + Tax |

| Edit button | You open the entered line for editing and it takes you to the interface for adding/editing a line from a Customs declaration. |

| Delete button | Delete the line you entered. |

The Clear button below the Result Table (6) removes all rows entered in the Customs Declaration.

Total (7)

The Total section (7) gives you information about all the totals of the sale you are creating in the following fields:

| Field | Description |

| Currency | Currency |

| Sum | Tax Mito |

| Tax | Value of the tax, and % |

| Total amount | Total amount = Fee + Tax |

In case you have lines with different tax rates in the Customs Declaration, separate fields for each different VAT value as well as the % VAT will be displayed in Total (7).

Base and Note (8)

In the field Reason (8) the reason for the transaction is filled in free text. The justification is displayed on the printed form of the document.

In Note (8) you can fill in whatever information you think is necessary in free text. The note is not displayed on the printed form, but is rather for internal use.

The customs declaration can be linked to Supplier Order/Stock from the P&S menu > Orders > Supply Costs.

Keep in mind that VAT is not accumulated as an additional cost to the cost of the goods, only the Duty is affected.

За да запазите промените, трябва да натиснете бутона Потвърди в Хедъра. Ако искате да излезете без да запазите промените, трябва да натиснете бутона Затвори.