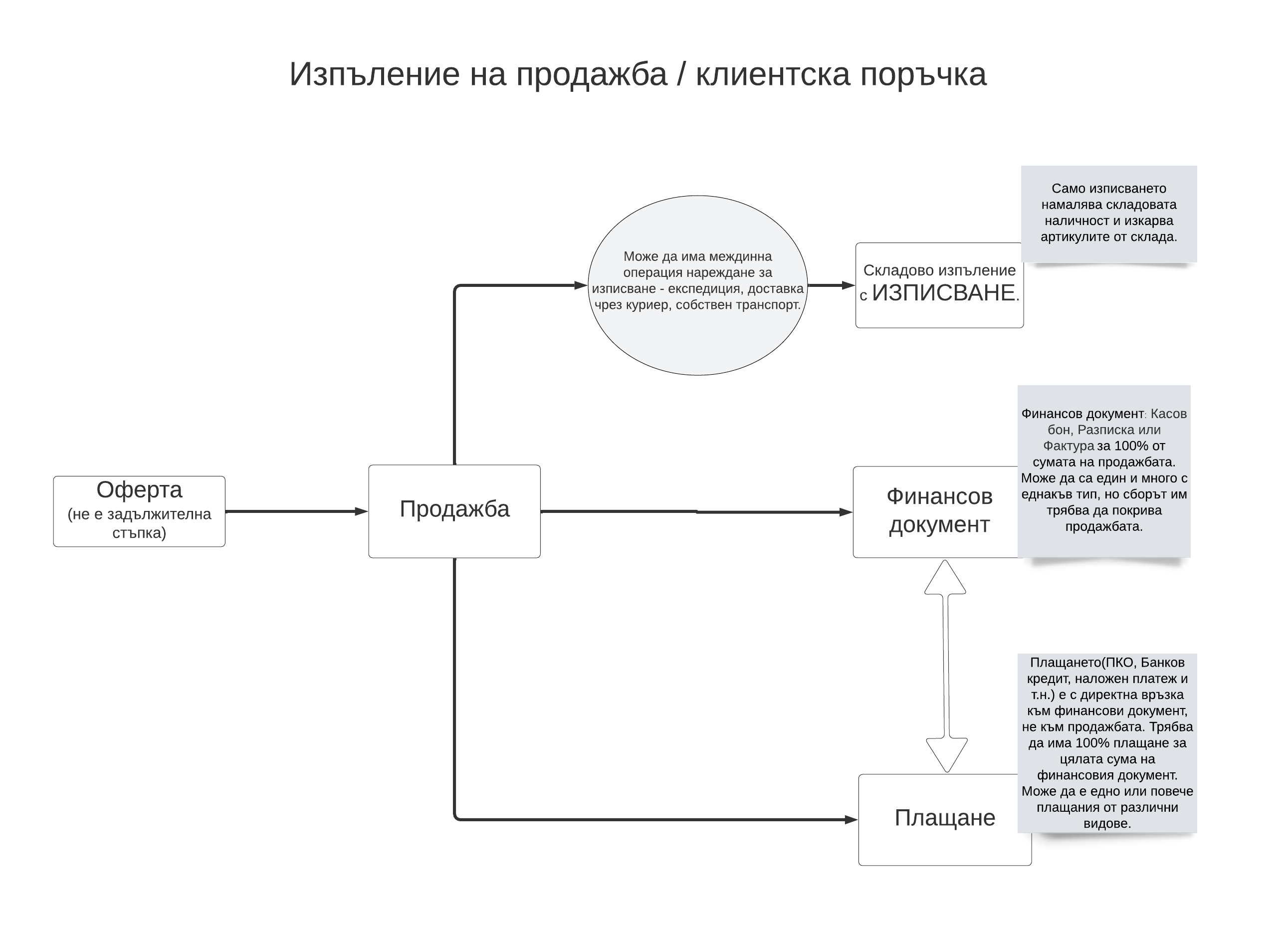

A sale is a type of transaction involving the sale of goods and/or services of a class for an agreed amount of money. In addition to the name “sale”, the process can also be encountered in the system as a “customer order” and is initiated from the menu P&S > Sales > New Sale or from P&S > Sales > Sales > Sale button.

After opening the interface, the transaction information should be filled in, which consists of the answers to the following questions:

- Who are you selling to?

- Who sells: POS, merchant?

- What are the terms of sale: type, method of delivery, invoicing and payment?

- What are you selling?

- What are the additional conditions: number, date, type of tax transaction and payment deadline?

1. Who are you selling to?

Search for the customer you are going to sell to with the search button already entered.

If the customer is missing from the list, check if it is entered as another counterparty type, for example supplier.

In case the client cannot be found in the system, use the create new client button.

2. Who sells?

POS: The POS field is an abbreviation of Point of Sale and translates to “point of sale”. From the combo, the specific point of sale for which the user has been given permissions is selected. The POS is pre-set with the company, office, store, cashier and warehouse in the system, which associates the subsequent financial and warehouse operations with them.

Merchant: The merchant of the sale is usually the user logged into the system and performing the transaction. Under more special conditions, the merchant can be replaced by a default one for the customer or a contract merchant that is set from the customer file.

3. What are the conditions of sale?

The catches depend on the configuration of the Sales Types.

Manner of delivery of the goods

Depending on the selected type of sale, the system offers the following options for handing over the goods to the customer:

- Direct – retail and wholesale

- From stock – for retail and wholesale sales

- Delivery – wholesale only

- Postponed – only for wholesale

Direct handover: direct handover is used in case the customer will take the goods immediately, i.e. they automatically leave the warehouse with a check-out operation and reduce the stock.

Transmission from warehouse: the transmission from warehouse generates a dispatch operation, or so-called pick order, which must be further processed by the person in charge of the respective warehouse. The dispatch does not reduce the stock, but is placed in Pending Operations for processing. In the case of a handover “from stock”, it is also possible to block the goods. In order for the goods to be removed from the warehouse and for the operation to be completed, a write-off must be made from dispatch .

Transmission with delivery: transmission with delivery is used in cases where the transmission of the goods of sale will be carried out by the integrated courier partners or own transport. When selecting this option, three additional fields “shipping method”, “shipping address” and the option to block appear. A dispatch is generated, which is processed in the completion interface.

Delayed handover: the delayed handover of the goods will not generate any stock transaction, the sale will remain completely unfulfilled from the stock part, but there is a possibility to make a block on the goods. When the goods have to leave the warehouse, manual dispatch and picking or direct picking must be done.

Method of invoicing

Depending on the type of customer and the type of sale, you can choose between the following financial documents:

- Cash receipt – for retail and wholesale sales

- Receipt – for retail and wholesale sales

- Invoice – for retail and wholesale sales

The role of the “immediately” checkbox placed after a financial document is to issue the selected document automatically.

Payment methods

- Number – retail and wholesale, for all types of financial documents.

- POS – for retail and wholesale sales, for receipt and invoice.

- Bank – only for wholesale sales with invoice.

- Cash on delivery – only for wholesale sales with invoice.

Count: payment in cash generates a cash receipt in the respective cash register.

POS: A POS payment generates a bank payment type “credit” to the preset account.

Bank: payment by bank transfer is deferred and must be generated manually in the selected bank account or by importing a bank statement.

COD: COD payment is deferred and should be generated automatically after a change in the status of the bill of lading generated by the integration with courier partners.

The role of the “immediately” checkbox placed after a payment document is to issue the selected document automatically.

4. What do you sell?

The addition of lines in the sale is done in an equivalent way, whether they contain goods or services. Please follow the link for detailed information.

5. What are the additional conditions of sale?

Document number

The document number follows the numbering set in the initial settings. The operation can also accept another number, which the operator can enter in the field only after pressing the “Manual number” checkbox.

Date of sale

The sale date defaults to today, and can be changed from the calendar below. By saving the sale, the date time of the transaction is also saved, and all documents automatically issued from it assume the same dates.

Type of tax transaction

To access the advanced settings on the sale regarding tax transactions, you need to click the “Finance” checkbox. By default, the most commonly used tax transaction is set to “Sales with 20% VAT”, but this can be changed to another of the pre-entered ones. The tax transaction has a direct bearing on the percentage of VAT charged on the price of the goods.

Payment term

To access the advanced settings on the sale regarding the payment term, you need to click the “Finance” checkbox. In the payment term field you can enter a payment term for the financial document other than the standard one. The figures are entered in days, for example if the period will be 25 days, you only enter 25 in the field.

To preview additional columns of the already entered rows in the table, it is necessary to mark a specific checkbox Discount, Final price, Taxes, Stock quantity, Availability and Price list.

Use the Create button to finalize the operation and generate subsequent documents if the conditions for this are met.

To abort the operation and exit the interface to create a new sale, use the Cancel button.