Interface for applying Sales Discounts, which can be used in cases where a mass price reversal of several or many sales to the same customer is required. The functionality allows applying a discount in several ways, depending on the desired result:

- Apply the same discount percentage to all selected sales. For example: you have an agreement with the customer, if he reaches a certain amount of goods purchased from you, to give him a 10% discount on all purchases made. When you put the percentage in the field in the Header (1), the system will calculate the total and unit discount amount automatically for each selected sale.

- Applying a different discount percentage for selected sales. For example: if you want to give different sales a different discount percentage, but have them combined into one stop payment document and credit finance document if they have a finance document issued. You may on a sale for a larger amount give a smaller percentage discount, and on a sale for a smaller amount you may give a larger percentage discount. The system will calculate the total amount and the single discount amount automatically.

- Application of discount as an amount based on total price. For example: when selling 10 pieces of item A worth 100 BGN you can give a 20 BGN discount for all items. Used when you know the exact total amount of the rebate. The system will calculate the percentage and unit amount of the discount automatically.

- Application of a discount as an amount on a unit price basis. For example: you have an agreement with the customer to apply a discount of 50 BGN per item for each item priced over 500 BGN when the amount of purchases is reached during the year. When you put an amount as a unit price discount, the system will calculate the percentage and the total amount of the discount automatically.

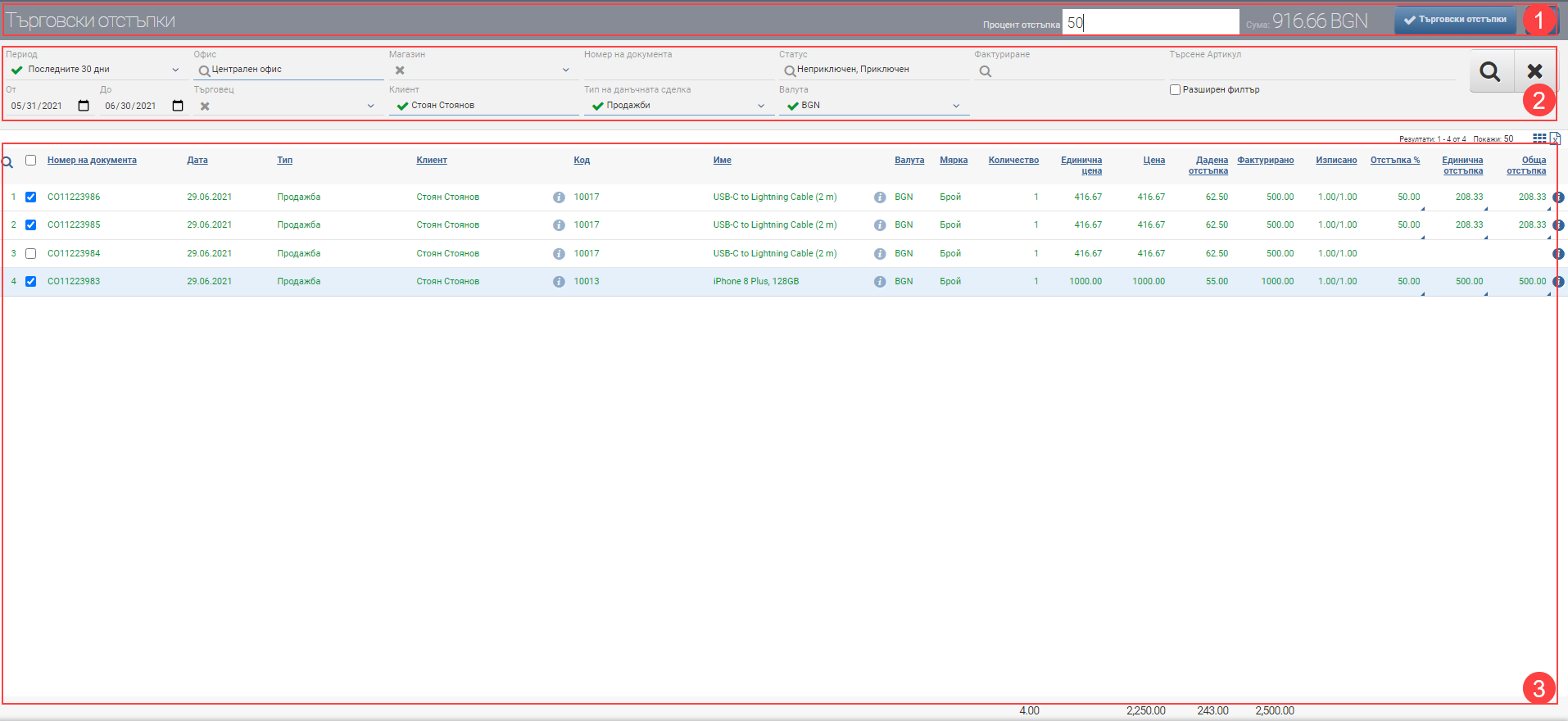

The Sales Trade Discount interface consists of Header (1), Filter (2) and Result (3) and is operated as follows:

Header (1)

In the Header (1) you see a field for Discount Percentage, which is freely typed in after you have selected the sales you will apply it to. The next field Amount indicates the calculated value of the discount. The Trade Discount button confirms the data entered and issues a Sales Reversal and Credit Finance Document. The last blue button is used to hide and display the Filter (2).

Filter (2)

In the Filter (2) you need to specify the basic information about the sales you want to reverse. It is important that the documents on which you want to apply a discount are identical:

- Client

- Type of tax transaction

- Currency

All the other filters help you to more easily find and precisely select the sales you want to include. The search is started with the Magnifying Glass, and the Hicks clears all filters. The different options are described in the table below:

| Option | Description | Further description of the options |

| Period | Choose from a drop-down menu for which period to display your sales. Works by document date. | The possible options are: – Today – Yesterday – The last 7 days – Last 30 days – The last 365 days – Current month – Previous month – Current quarter – Previous quarter – Current year – Previous year – Until today |

| From date/To date | You filter based on when the sale was made. | |

| Office | You select the office from which the sale was made. | You may select more than one office, but note that you cannot control which office will issue the subsequent credit finance document. |

| Merchant | You choose the trader who made the sale. | |

| Shop | Select the store from which the sale was made | |

| Client | You choose a client. | |

| Document number | Allows you to search by document number. | |

| Type of tax transaction | Select a tax transaction type. | |

| Status | Filter by sales status. | The statuses are as follows: – Pending/active status An active sale is one on which one or more of the following actions have not been taken:: – No financing document has been issued for all or part of the amount and/or quantity of the sale. – No payment has been made for all or part of the amount of the financing document upon full invoicing of the sale. – Not all or part of the quantity is listed in the sale. – Completed status A completed sale is one in which: – There is a financial document issued for the full amount and the full quantity of the sale. – There is a write up done for the entire amount of the sale. – There has been payment made for the full amount of the finance document. |

| Currency | Filter by sales currency. | |

| Invoicing | Filter by billing method selected in sales. | |

| Search Item | Free field to search for an item by word, code, brand, etc. | |

| Advanced filter | If you put a check mark on the Advanced filter, you will see a few more search fields which include Categories, Brand, Features and Supplier. |

Result (3)

The result (3) will be a list of sales rows based on the criteria you have specified. The information is summarised in a table with the following columns:

| Column | Description |

| Checkbox | This is where you indicate on which lines of sales you would like to apply the in-store discount. Once you place a check in front of the desired line, the Discount %, Single Discount and Total Discount columns , as well as the Discount Percentage field in the Header (1), become free to write. |

| Document number | Displays the number of the sale in which the line is included. |

| Date | Document Date. |

| Type | Document type |

| Client | Shows the customer associated with the sale. |

| Opens a customer file. | |

| Code | Item code from the order of sale. |

| Name | Name of the item in the sale order. |

| Opens an item file. | |

| Currency | Shows the currency of the sale. |

| Measure | Measure the item in the order of sale. |

| Quantity | Quantity sold. |

| Unit price | Unit price of the item on sale |

| Price | Total price of the item on sale. |

| Discount given | Shows the discount already given on the sale. |

| Invoiced | Shows how much of the sales order amount has already been invoiced. |

| Retrieved from | Indicates how much of the line quantity of the sale is listed. |

| Discount % | Shows what percentage of the unit price the discount is. The field becomes free to write after selecting the line and here you can specify a discount percentage for a specific line. |

| Single discount | Shows the discount for an item. The field becomes free to write after selecting the line and here you can specify a single discount for a specific line. |

| Total discount | Shows the entire discount. The field becomes free to write after selecting the line and here you can specify a general discount for a specific line. |

| Opens a file on the sale. |

Note that the fields in the % Discount, Single Discount and Total Discount columns are linked. If you change one of the values in any of them, the others are calculated automatically!

You can apply a different form of discount to each order! For example, on line 1 – put single discount, on line 2 – % Discount, and on line 3 Total Discount. However, if you then apply the Mass Percentage Discount from Heather (1), it will change everything written along the lines so far.

A brief step-by-step description of the procedure for applying the Trade Sales Rebate (TSR):

1. Filter and find the sales lines you want to apply a discount to.

2. Mark the sales lines by placing a check in the checkbox in the Result (3).

3. Put the TO under any of the above forms ( percentages/unit price/total price):

– TO as a total percentage of all selected sales lines. Highlight the lines and type in the Discount percentage field in the Header (1). The discounts will automatically be calculated and added to the corresponding Discount columns in Result (3) for the rows you select.

– TO as a different percentage for selected sales lines. Highlight the rows and type in the boxes in the Discount % columns in Result (3).

– TO as a unit price for selected sales lines. Highlight the rows and type in the boxes in the Single Discount columns in Result (3).

– TO as total price for selected sales lines. Highlight the rows and type in the boxes in the Total Discount columns in Result (3).

4. Confirm the application of the TO with the Trade Discount button in the Header (1).

5. A Price Reversal screen is generated for you and must be confirmed. Note the “Invoice immediately” checkbox in Staging. If you want to issue a credit financial document, leave it (it is checked by default). If you remove it, you will have to issue the financial document later.

6. From the reversal, a Credit Finance Document is automatically generated for you ( if the “Invoice immediately” checkbox is left in the Reversal). It can be found in the Related Operations tab under Storing.