The debit note increases the amount due on a given revenue/expenditure financial document.

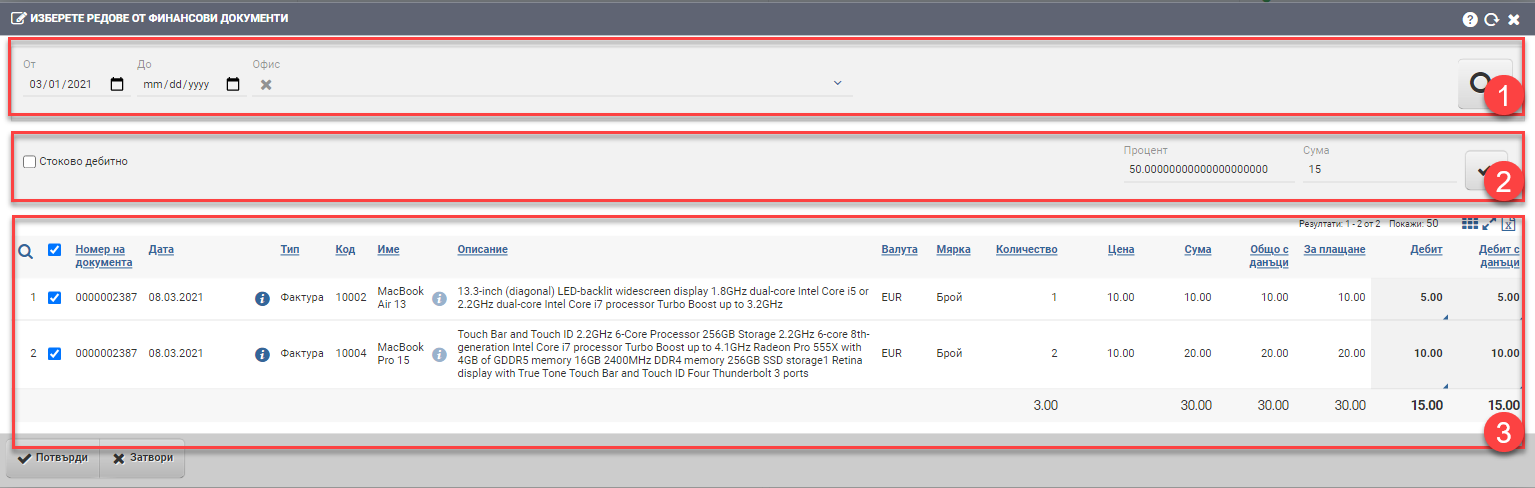

The interface for debiting financial documents consists of Filter (1), Additional settings (2) and List (3):

Filter (1)

Use the Filters (1) to manage the results in the List (3):

| Field/drawer | Description |

| From date By date | Filter based on date of financial documents. |

| Office | Filter based on the office where the financial documents were entered or the office from which they were issued. |

Additional settings (2)

In Additional Settings (2), there is an option to note that you will debit a quantity by placing a check in the “Goods Debit”.

How does it work?

Example: you want to debit one invoice with two lines. In one row you have 1 piece of item X at a price of 10 BGN and in the other row you have 2 pieces of item Y at a total price of 20 BGN.

You put a checker on a stock debit, choose which lines you will debit. Let’s say you increase the quantity in the order with item X by 10 pieces- the system will calculate a flow of 10 pieces at a price of 100 BGN ( 10 pieces at 10 BGN each, as 1 piece costs). In the line with items Y you will increase the number of items by 20 – the system will calculate 20 items for 10 BGN -> 200 BGN. So, once you confirm the lines and they are added to the Debit Note, its amount will be 300 lv.

The system also allows you to apply a mass debit to all financial documents issued/entered in a given period, office and tax transaction. There are two ways to do this:

- by percentage

- by amount

Once you have decided what percentage/amount, and selected by placing ticks in the rows with the financial documents, you need to press the button to the right of Mass Application (2). This will automatically calculate the percentage of each line of a financial document.

How does it work?

Example: you want to debit an invoice with two lines. In one row you have 1 piece of item X at a price of 10 BGN and in the other row you have 2 pieces of item Y at a total price of 20 BGN.

If you apply a mass percentage of 50% to both rows, then in the row with item X the system will calculate a debit of BGN 5, and in the row with items Y – BGN 10. Thus, the total amount of the debit note will become 15BGN.

Similarly, if you have the same case but want to apply a mass debit by amount, you need to type 15 in the amount field. The system will then automatically calculate the percentage and apply it to the selected rows.

The two fields for percentage and amount are linked and once you type in one, the other is automatically calculated.

List (3)

The list shows rows of invoices with the following columns:

| Column | Description |

| Document number | Invoice number |

| Date | Date of revenue/cost invoice |

| Info button | Opens a financial document file |

| Type | Type of financial document – always an invoice |

| Code | Invoice item/service code |

| Name | Name of item/service |

| Info button | Opens an item/service file |

| Description | Description of the item/service/category |

| Currency | Invoice currency |

| Measure | Measure |

| Quantity | Invoiced quantity |

| Price | Unit price without taxes |

| Sum | Total = unit price*quantity |

| Total with taxes | Total with taxes |

| For payment | How much of the total has not yet been paid |

| Debit | Amount of debit net of taxes. The field(s) are “unlocked” for writing when selected by inserting a debit line(s) check. |

| Debit with taxes | Amount of debit with taxes. The field(s) are “unlocked” for writing when selected by inserting a debit line(s) check. |

To add the line to the debit note, you must click the Confirm button. If you want to exit without saving your changes, you need to click the Close button.